People at all times used the opportunity to lend money, if not from friends / relatives without extra charge, then at least from professional creditors.

Our ancestors went to the usurers, now there is an opportunity to apply to the bank, and the bank - the most reliable of all existing.

If you need money, it's worthwhile to figure out how to take a loan from Sberbank , because this largest bank in Russia is distinguished by favorable lending terms.

Many people have already made sure of this and you have a chance to fill up their number.

Sberbank: how to take a loan from this bank and what is it like?

Sberbank is the oldest and largest among the numerous banks of the Russian Federation. The range of services it provides is simply huge and, of course, lending is not the last place in it.

Sberbank: features of this financial institution

The history of the Savings Bank begins among the savings banks of the Soviet Union, the first of which was opened in 1922.

Gradually, these cash departments were reorganized into one financial institution, which was subordinated to the State Bank of the USSR.

And in 1990 the Sberbank of the USSR was founded, which in 1992 ceased to exist in order to be reborn in 2001 and over a decade and a half to become a leader among financial organizations of the Russian Federation.

Sberbank is a joint-stock company, with 50% of the shares( + one voting) owned by the Central Bank, which is state-owned, the rest shares divide almost 10 thousand Juras.and nat.persons.

Undoubtedly, such an impressive state share of the shares indicates that the reliability of this bank can not be doubted.

In addition to reliability, Sberbank is also distinguished by the global prevalence of offices, not only in Russia, but also in other countries: Ukraine, Kazakhstan, Belarus and others.

Residents of Russia can go to one of the tens of thousands of units to take out a loan, make a deposit, transfer money, pay a communal or use any other service.

Modern Sberbank almost does not resemble the Soviet savings banks.

The lack of large queues, friendly service, a wide variety of services, low interest rates on loans, high deposits, online banking, mobile applications and other benefits attract hundreds of millions of customers annually, not only in Russia, but also abroad.

What kind of loan services does Sberbank offer?

With a modern salary level, even for middle-income people it is very difficult to save money for a large purchase, what can we say about those who can not boast of decent incomes.

What should I do? Do not buy machinery, cars, housing? Do not go to rest? You can, of course, and so do, but it is more desirable to still be able to enjoy the small joys in life.

You will succeed if you figure out how to take a loan from Sberbank.

Sberbank provides a variety of conditions for lending and a sufficient selection of products.

Applying to the manager and specifying exactly what you are borrowing money for, how long are you going to give them, you can choose for yourself the best option with the most loyal conditions.

You can get money on favorable terms( interest rates here are among the lowest).

Of the advantages also - a lot of suggestions, so that each client could choose the most profitable and inexpensive option for themselves.

The most popular types of loans that can be borrowed from Sberbank:

-

A consumer that does not require security.

This is one of the most popular types of loans that this bank issues.% rate - from 14.9.

You can borrow any amount up to 1.5 million rubles inclusive.

The return period is up to 5 years.

How to get money from the state and what to spend it on?

For example, if you are borrowing 50 000 r.for a period of 2 years at 14.9% per annum, the calculation will be as follows:

-

Consumer with a guarantor - fiz.face.

If you find a person who is solvent, with an impeccable credit history, or even better - a client of the Savings Bank who agrees to become your guarantor, you can take 3 million rubles at 13.9 - 14.9% per annum.

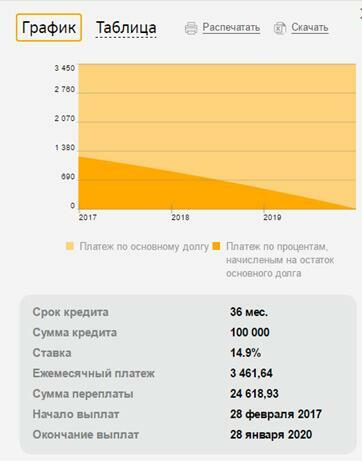

For example, you want to borrow 100,000 rubles on credit for 3 years.

Your monthly profit and your guarantor is 30,000 rubles.

This is what the schedule of your payments looks like:

-

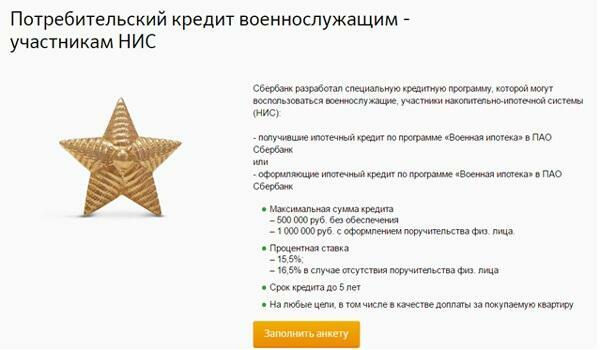

For military and combatants.

Credit conditions are acceptable:

For example, you needed 50 00 rubles for 5 years.% rate in this case will be 16.5, and every month you will have to pay 1,229.23 rubles.

-

Non-purpose with the availability of real estate, which can be used as collateral.

You can borrow up to 10 000 000 r.

The interest rate will be from 14%.

You will have enough time to repay the money: at least 20 years.

Let's say that the property you want to buy and that will also act as collateral will cost 4 million rubles.

You are ready to make an initial contribution of 40% of the total cost and have a monthly income of at least 50 000 rubles.

So you can ask for the missing amount and pay it, for example, for 5 years under these circumstances:

-

Consumer, which you take in order to refinance already existing debts.

This will give you the opportunity not only to reduce the credit burden, but also to receive funds for other purposes.

You can borrow at 13.9% per annum to 1 million rubles.

More detailed information on the terms of the transaction can be found on the website: http: //www.sberbank.ru/ru/person/credits/money/ consumer_refinance

-

Mortgage.

One of the most realistic opportunities for a young family to buy a home is to take a mortgage.

Sberbank offers several options for mortgage loans on favorable terms.

Read the options to make a final decision, you can go to: http: //www.sberbank.ru/ru/person/credits/ home

-

Credit cards.

This type of services can not be attributed to traditional loans, but you will agree that having a credit card in your wallet makes life much easier.

Especially when you urgently needed money, but there is no time to fidget with paperwork and wait 2 days to get the full amount.

Sberbank offers a lot of attractive options for bank cards, the terms of which can be found at: http: //www.sberbank.ru/ru/person/ bank_cards / credit

How to take a loan from Sberbank and to whom is it available?

Can everyone take a loan from Sberbank? Of course, not all!

Any banking organization, wishing to hedge and not wanting to lose its money, makes very specific demands on borrowers, which is very difficult to circumvent.

Which bank is better to invest in?

How can I take a loan from Sberbank and who can do it?

According to representatives of the Savings Bank, the portrait of the ideal client who can take a loan will be like this:

- A man or woman who is already 21 years old, but who have not crossed the 65-year mark.

- Anyone who has a stable income( whether from work for a state / private company or from his own business, the main thing is to be able to confirm his solvency documented).

- One who has a certain length of service:( the total length of service should be from 1 year, at the current workplace - from 6 months).

- A person with an impeccable credit history in Sberbank or some other financial institution.

- A man or woman with a decent income( at least 30,000 rubles a month) to be able to borrow a large amount.

The clients of this financial institution have a great chance to use the loan product from Sberbank.

For example, if you have a salary or pension card issued here, then you do not apply for seniority, and checking your documents will not take too long.

How to take a loan from Sberbank with a bad credit history, if you really need money?

If you have a bad credit history, then it will be much more difficult for you to take a loan from Sberbank.

Not only this bank, but also other financial institutions of Russia try not to deal with those who have already lent money at interest once, but never returned it within the specified period.

And yet, your chances are small, but not hopeless.

To increase your chances of taking a loan with a bad credit history, you will be able to:

- Provide information on the stable and large income that you have to date.

- You will find a solvent guarantor with a good credit history.

- Offer as collateral something really worthwhile, for example, real estate.

- Become a client of the Savings Bank, for example, open a debit card here or make a deposit.

- You will not ask for a large sum of money, but only a few tens of thousands of rubles( by paying this amount without violations, you can ask for more money in the future).

How to get rid of the loan: 6 useful tips

If you fulfill all these conditions, then a bad credit history will not be a hindrance to getting money.

But try not to violate the terms of cooperation with the bank in the future, because someone is unlikely to give you a third chance.

More details about consumer loans in Sberbank, about conditions and nuances - you will learn from the reportage of Artem Zavarzin:

How to take a consumer loan in Sberbank: the algorithm of actions

The easiest way to take a consumer loan is to go to the nearest Sberbank office, listen to the manager's story, choosea suitable option for yourself, present all the documents that the manager will tell you and wait until the bank employee issues everything.

Usually the loan processing time does not take more than two days, although in some cases this period may increase.

If you do not want to go to the office all the time, then you should register in Internet banking( for this you need to be a customer of Sberbank) here at this link: https: //online.sberbank.ru/CSAFront/async/page/ registration.do

and fill in the online application for the credit product you have chosen.

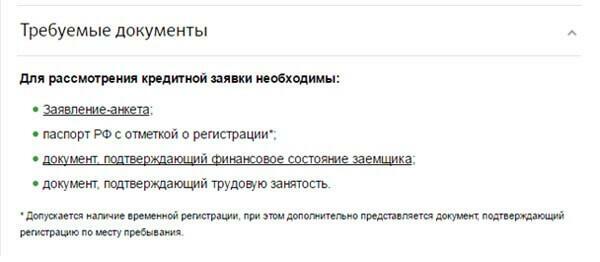

Documents that need to be presented to the bank in order to take a consumer loan:

- completed application and confirmation of solvency( their samples can be downloaded on the site);

- passport with registration stamp;

- confirmation that you have a job.

If a bank employee makes sure that you are a reliable customer, you will receive your money in one of the branches( in the area where you are registered).

Read the terms and terms of debt repayment in order not to violate them and not to overpay due to a run-in penalty.

Understand how to take a loan from Sberbank , it's very simple.

If you do not have enough information in the article and the data that is on the bank site, go to the office - the manager will be happy to answer all your questions.