Sold out on the Internet office furniture, blinds in the empty rooms are lowered and the director's favorite ficus is immersed in the car - you close the company( limited liability company).

And let the new accomplishments await you, but what if the enterprise has debts at the moment?

How not to hit the dirt in front of your employees, partners and tax specialists?

Read about how to close LLC with debts competently.

We will talk about all the subtleties of this difficult matter.

3 acceptable methods, how to close an LLC with debts and not get caught off

Method No. 1: Bankruptcy is not the end of the world, but a chance to change everything

In fact, the bankruptcy procedure is the only legal solution to the problem of how to close an LLC with debts and can be held:

-

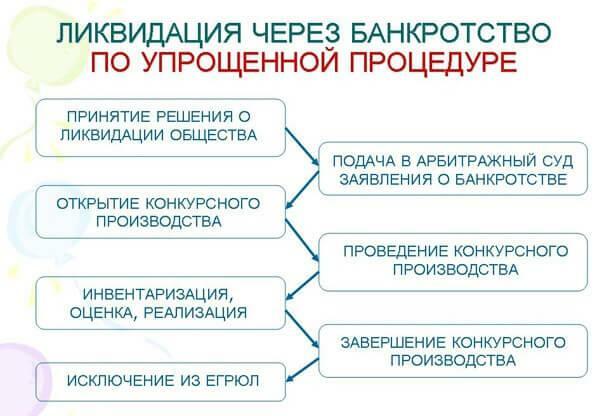

by a simplified procedure.

With the voluntary liquidation of the LLC, when both the owners and the management of the company came to the conclusion that it was a matter of seams and something to do with this:

- An intermediate balance( liquidation) is drawn up.

-

The liquidator confirms the existence of indebtedness, which LLC is certainly unable to pay off and goes to court with a statement that the enterprise is declared bankrupt.

The law says that the liquidator can be a lawyer, chief accountant, director, founder and even an ordinary employee if he agrees to go through all the circles of bureaucratic hell.

But it is unlikely that a dismissed employee will be loyal to the "throwing" of his leadership.

-

Of the persons proposed by the LLC, that is, by the debtor himself, the court selects an arbitration manager.

The idea is that this same manager, deciding how to liquidate a society with a heap of debts, may demand that the founders be brought to justice for bankruptcy.

They have to repay the debt at the expense of personal money and property.

But since the manager was selected from the list submitted by the representatives of LLC, the chances of such a turn of events are almost zero.

-

LLC is closed, and debts are safely written off to the joy of the founders.

True, all this happens after everything is described and implemented, that can only be sold from the company's property to pay off with creditors.

-

for the full procedure.

This scheme has its own peculiarities:

- An application for recognizing an enterprise by a debtor can be filed not only by itself, but also by an angry creditor.

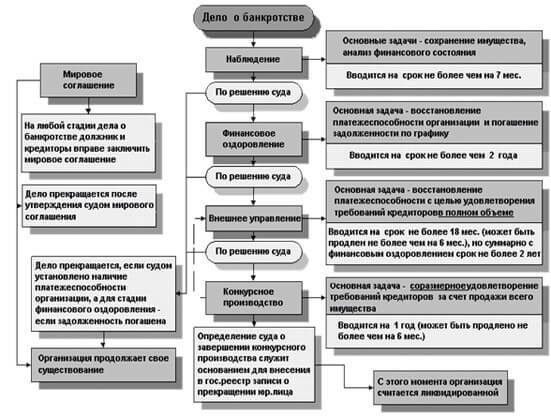

- According to the court's decision, supervision is organized over the LLC, which is aimed at either improving the financial situation or closing and distributing debts.

- Further, the bankruptcy procedure practically does not differ from its conduct according to a simplified scheme.

-

It is of great importance who initiates bankruptcy.

After all, if this is done at the insistence of the creditor, then, as a rule, the bankruptcy trustee appointed by the court will in every way defend the interests of the one to whom they owe.

More details of the full bankruptcy scheme are shown in the infographics:

In any case, one can not do without consulting with experienced lawyers.

Method No. 2. How to close a company with debts "through the knee": elimination forced

Perhaps the most unpleasant situation for any company with an unpredictable finale.

Creditors, after long admonitions and requests to pay off, can decide on such a step as to close an LLC with debts and try to return their money if:

-

, the founders recorded in the documents are in fact a nominal person, such an English queen without special rights and powers that do not go into business:

- , this situation can develop on "one-day" companies, open for the sake of immediate benefits and solving any problems,then legal formalities;

-

even worse picture, if the former owners of the enterprise, having accumulated debts, sold the company, having issued the general director a front man, this "scapegoat".

It should be remembered that with the help of law enforcers such unscrupulous founders are easy to find.

And then there will be subsidiary responsibility.

To be in charge of debts, LLC will have its property, that is, everything that "is acquired by excessive work";

-

founders are hiding from creditors.

So do those who have good connections and are sure that the police will not be too zealously searching for them, or iron nerves and a thirst for adventure;

- recorded clear violations of the current legislation, including the failure to pay its debt obligations;

- there is no license or other permits for the operation of the LLC in a particular field;

- revealed unfair competition, which violates legislative norms;

-

is actually an LLC with no debts.

If no transactions are recorded within 14 months of the settlement account of the enterprise, it makes sense to begin the liquidation procedure( forced).

In order to forcefully close an LLC with debts, you need to go through the following stages of :

- Submission to an arbitration court by an interested legal entity - counterparty or supervisory organization( for example, tax inspection, Antimonopoly Committee, etc.).

- If the court after the hearing ruled to liquidate the company with debts, then appoint a bankruptcy administrator, who organizes the whole process.

- The manager informs the public that the LLC is being closed( through the media).

- Each employee is notified in writing of the liquidation of the firm and is calculated with it.

- Settlements are made with all counterparties( suppliers, buyers, etc.).

- The tax service is notified that the LLC with debts is terminated.

- If creditors are lucky and after the closure of the company, something remains, this property is shared between them.

Most often, the tax inspection is the initiator of the closure of the LLC with the dogs.

This measure is applied to the most malicious defaulters.

The whole procedure is carried out at the expense of the firm, which is liquidated.

What you need to open an LLC: 5 nuances

Method No. 3. Signing yourself a "death certificate": how to close an LLC with debts in case of voluntary liquidation of

- The fees of founders( general) take a decision to liquidate a firm and choose a liquidation commission or one liquidator.

- The liquidator reports the voluntary liquidation of the LLC to creditors( in writing), tax specialists( application), the public( via announcement in the media).

- After the appeal of all interested persons, lists of creditors are formed, the firm is calculated with debts.

- If there are no assets for redemption, it is advisable to start a bankruptcy procedure under a simplified scheme.

- When the enterprise collected the money that was owed to it and paid off with counterparties, a liquidation balance sheet is drawn up, the property is shared among the founders.

The main "plus" of this method is its transparency and legality.

After the completion of the entire procedure, neither the tax authorities nor any other creditors will be able to issue you any claims.

"Minus" is that the "draconian" tax audit will not be avoided, but if you are confident in the perfection of your financial documents - you and the flag in hand!

And if the tax inspection drags out the terms of the check, we advise you to sue, referring to the procedure established by law.

2 alternative ways how to close an LLC with debts for the most craziest founders and compare them with the bankruptcy procedure

If there is no special desire to communicate with debtors and the spirit of adventurism has not died in you, you can try two bold ways to solve the problem.

Method No. 1. Reorganization: change the skin like a snake

If you are ready to approach the problem outside of the standard how to close an LLC with debts, you can try to hide by:

- joining another company;

- to merge with another firm.

At the same time, all "jambs" are transferred to the legal successor( the enterprise, which included LLC), including your debts.

How to close an IP with debts: a step-by-step plan and 5 tips

But before you close an LLC with debts in this way, you should know about such pitfalls:

-

you will have to report on the forthcoming reorganization to all your creditors.

They, according to the law, have the right to suspend this process.

As a matter of fact, your "masquerade" can end, never having begun; -

if your "sins" before creditors are not too significant, then you can still expect that they will be covered by a new legal entity.

But when it comes to significant amounts, it is unlikely that its founders will show "an attraction of unprecedented generosity" and will pay your debts.

There are legitimate mechanisms to attract former owners of such LLC debtors to account.

Method № 2. Sale of the enterprise: fly, has fallen in price!

In fact, such a scheme is a substitute for the leadership of the general director or founders.

They will have to dry their heads over how to close an LLC with debts, but:

-

hardly a far-sighted person will give consent to lead the company with a "bouquet" of debts.

Therefore, usually a purchase is made for a front( nominal) person;

-

, even if you managed to find such a "Samaritan", then when you "raid" the tax with the requirements to pay off the budget, he will round his eyes and talk about what he first hears about the debts of the LLC, and does not know how to properly close it.

In the end, all the stars will converge on the former grief-leaders and they will be attracted to subsidiary liability, that is, the debt will have to be repaid at the expense of personal property.

From the video you will find out what documents are required when liquidating LLC:

And it would be desirable and pricked. .. or how to close a company with debts beautifully

Dock lawyers do not advise flirting with the law and actively argue for a legal procedure - bankruptcy:

In a difficultthe situation founders in the right to decide independently, how to close the LLC with the debts of .

However, you need to clearly understand all the risks for yourself and be ready to bear responsibility for your actions, including those that are not faulty in terms of the law.