If you need to enter into a contract for the purchase / sale of products or the provision of a service, you will come across a concept such as an "invoice for payment".In our time - a very convenient way to make a transfer of funds.

Today we will analyze how to correctly bill for and what pitfalls are waiting for you along the way.

What is an invoice for payment and when should I set it?

This is a document that is evidence of a transaction for an accounting department, firm or other organization.

If you are engaged in any business, then without knowledge of this section you just can not do.

The legislation of the Russian Federation does not provide for the conclusion of transactions without contracts. The counterparty signs an act in which the main clauses of the contract with the payment option appear.

In some cases, conditions may omit the item on the method of payment: then you are not required to conduct the transaction through billing.

When to invoice the account without fail:

- If the company works in the market and is exempt from VAT on article 145 of the Tax Code.

- Paragraph 1 article 169 of the Tax Code of the Russian Federation - the trade process is documented from a personal name and with the use of a DOS.

- Article 168 of the Tax Code of the Russian Federation - the enterprise received a partial advance payment.

This is one of the fastest options for making a calculation between contractors.

In addition, it is an easy way to receive payment in oral agreements on the transaction, when the settlement is made upon the arrival of the goods to the buyer.

How to correctly invoice for payment?

As the invoice for payment does not fall under the article of the Law No. 402-F3 of the Russian Federation "On Accounting", strict requirements for registration can not be presented to it.

The structure of the document has developed in the process of market relations for many years. It is considered a good idea to submit a document that is as close as possible to the established canons.

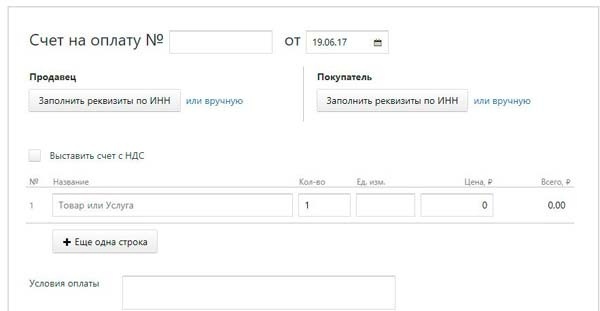

Methods of filling out the account:

-

Get the form via the World Wide Web in. doc format and print it on A4 format with subsequent filling by hand.

Save the document on your computer and use it as a template for subsequent transactions.

- Fill in the form with all the details in electronic form.

-

If you are an employee of a firm or other organization where predefined specialized software - accounting software - use it.

Minimum number of errors + the ability to track the payment process of the subject of trade.

-

Download one of the accounting software and run it for a trial period.

This time is enough for you to properly draw up an account.

If you undertake to make out the form yourself, you will have the opportunity to enter additional information that is necessary for you personally. This option is possible if the subject of trade has a certain degree of specificity.

Generally accepted information on the invoice for payment should include:

- The name of the organization that makes the transaction( the supplier of products / services) in full or in abbreviated form.

-

Legal and actual location of the enterprise.

Include contact details and a link to the official website.

-

The service provider maintains its own accounting.

Therefore, the document must contain the serial number of its firm.

- The time and actual date of the act.

- Taxpayer Identification Number - INN.

- Code of the reason for the statement, which is assigned by the tax authority - CAT.

- Requisites for payment for the goods / services of the enterprise that provides services.

- Full information about the company that purchases / receives services + its contact information with an official website.

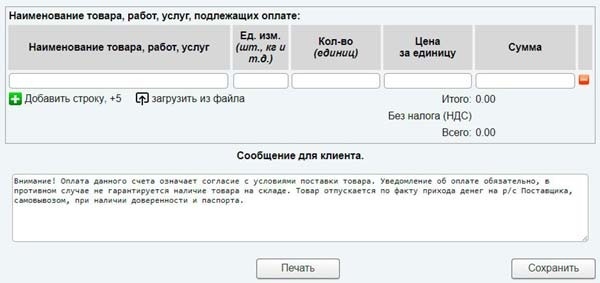

- The most accurate information on the product / service.

-

The final value of the cost is recorded to the accuracy of kopecks.

It is desirable to add a column with the price in words.

- If there is a value added tax, you need to enter the relevant information on it.

-

Painting of the owner of the enterprise that provides services, and his accountant.

Certified by all round print.

If you are a private entrepreneur, only your mural will be enough.

The data of the considered list are considered obligatory for filling, but nobody has the right to limit them to you.

The accountant of the firm can make amendments and additions depending on the situation:

The invoice for payment goes as an addition to the main document on execution of the transaction for the purchase / sale of goods or services.

The contract contains guarantees for the contract and conditions stipulated in advance.

1) How to invoice for payment by bank transfer?

If you are the owner of a more or less large firm, then a non-cash payment is the best option for payment. The process becomes very operational and speeds up the processing of documentation by accounting departments.

How to transfer the invoice:

- by fax;

- to the buyer's mailbox;

- from hand to hand;

- by direct mail delivery.

Blank looks no different from the standard, except for one moment.

It is necessary to create and conduct an electronic digital signature.

This element is required if you intend to conduct further electronic cashless transactions. There are many legal offices in the market that provide such a service.

If desired, it can be issued as soon as possible.

2) How to insert an invoice for payment for LLC and IP?

Unlike private organizations, large companies make daily purchases of goods, which requires constant work on the design of contracts and accounts.

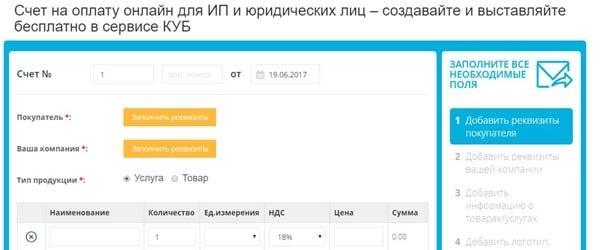

In such cases, the optimal option will be the use of specialized CRM programs to automatically compose forms for each account individually.

List of free CRM programs:

- megaplan.ru

- clientbase.ru

- zettaplan.ru

In addition to invoicing through special programs, departments of organizations can independently conduct each transaction with an adjustment for the customer.

The first option is clearly faster and allows you to reduce the number of errors to a minimum.

In addition to the points specified above, the invoice for payment must still contain:

- data of the limited liability company( CAT, OGRN and others);

- information of the bank that provides services( BIC, settlement account and others);

- all-Russian classifier by branches of the national economy;

- all-Russian classifier of enterprises and organizations.

Having indicated all the necessary information, the head or accountant of the organization signs.

If any corrections have been made, please re-assure the form.

3) How to bill with VAT?

Value added tax is often indicated in the invoice for payment.

Its allocation is not a mandatory requirement, but remember that this step will help to avoid mistakes in further calculations of the total cost.

The sample is the same as for LLC.The only difference is that at the end of the form it is necessary to indicate the amount of VAT that will affect the final payment for the products.

In order to avoid any oversights, an invoice is issued. This is a document that is filled in by template, and on the basis of which the recipient of the goods draws conclusions about VAT refund or deduction.

In other words - commodity waybill.

4) How correctly to invoice for payment in English?

Unlike standard acts, it is necessary to specify all the details of the transaction, in order to avoid misunderstandings after acceptance of the goods / services.

Therefore, a person who composes such a document must have a high level of command of English.

Account Content:

- What is the name of the organization that makes the deal.

- Basic requisites.

- Company logo + shortened title.

- Information for communication.

- Requisites for payment.

- Detailed conditions of the transaction( in what currency payment, time and date of the calculation, order number of the order).

- Information about the customer( organization name or private person's name + legal address of residence).

When concluding a contract with a large firm, you must specify the employee responsible for conducting the transaction.

You need to make a calculation using specially numbered accounts.

In the central part, make a detailed description of the product or service that you provide to the customer.

Product description must contain:

- product characteristics;

- cost per 1 product unit;

- discounts on products( if any);

- the amount of tax to the treasury of the country;

- final amount of funds for payment

When you want to invoice for payment, very carefully refer to this section. Foreign companies are often very picky about choosing suppliers.

The document will influence the decision on your future cooperation.

In the end, indicate additional information about possible penalties and payment terms, as well as fines when detaining transfer of funds.

Complete the thank you to the buyer.

Can I bill an individual?

Billing for payment implies the tax liability of the organization to the budget of the country. VAT individuals do not pay due to lack of registration of a private entrepreneur.

Even with all the desire, directly you can not draw up an invoice for payment for an organization. Large companies will not be willing to pay you this way, exposing themselves to excessive taxation.

In such cases, a contract is made for services from a physical person with agreed terms and amount of payment.

A simplified version of how to bill for

What if you are a beginner and do not understand all the subtleties of accounting? The question "how to bill?" Can become an insurmountable barrier, especially if you close a deal in a short time.

Use legal advice or search for information on specialized forums - will be one of the methods to solve the problem.

But there is one more. Simple and straightforward - using online services.

Top 5 online billing services

-

www.b-kontur.ru

Site with step-by-step instructions and the ability to send an already prepared invoice for payment to the buyer via e-mail.

-

expose-account.rf

The resource will allow not only to bill, but also to track the payment process.

It is possible to maintain personal accounts at the level of a private entrepreneur.

-

kub-24.ru

Nothing superfluous. Prompt sending to the mail and alert the buyer.

You can save as a template in several formats on your computer.

-

naoplatu.ru

Video instruction + the ability to save a template to a computer.

If you wish, you can issue an invoice for payment on a regular basis at a certain time.

-

service-online.su

Additional options for configuring the form for payment. The designer will quickly make up and invoice.

Add fields to the product name and upload additional documents to send will not be any problems either.

The procedure will not take much time, and when registering on the websites, it will be possible to send invoices on a regular basis through the personal cabinet.

Convenient for private entrepreneurs and small organizations.

What errors are allowed when invoicing for payment?

Attention when filling in the form is very important.

Having analyzed the most frequently encountered problems in drawing up invoices for payment, we identified the most significant ones.

Errors when invoicing:

-

Signature of the chapter or accountant without decryption.

When sending an electronic document, the error is excluded due to the presence of a digital signature on the form.

-

The date of compilation does not coincide with the date of invoicing to the buyer.

-

The account for payment was not provided on time, because of what did not meet the tax period for VAT.

Keep logging of postal entries to avoid this problem.

-

Different dates on accounts payable to buyer and seller.

The problem occurs when the document is already sent to the buyer and only after that the corrections are made.

-

The form cap is incorrect.

Carefully provide information and contact information.

Elimination of the above errors will allow without wagons to conduct transactions on the transaction and receive payment as soon as possible.

If disputes arise, inaccuracies in the invoice for payment may entail financial losses for the organization.

As you understand, there is no general template as such. Most often it is put up for prepayment under a contract.

Do not know how to invoice for payment?

Then take a look at this video instruction:

When deciding whether will issue an invoice for , you can contact online services or download templates for each case on the Internet.