Do you dream of having your account state, like Bill Gates, next to your wife - more beautiful Giselle Bundchen, and your home - more luxurious than the hotel "Hilton"?

Well, buddy, we can give only one piece of advice to make blue dreams come true - take responsibility for your well-being in your own hands( because we do not know any more reliable!) And submit to free entrepreneurial breads where earnings depend on you,but not "good uncle".

We offer you to submit documents for registration of LLC( limited liability company).

3 "reinforced" arguments in favor of filing documents for the registration of LLC or if firms are open, it means that someone needs

-

Even a complete layman in "business affairs" is able to collect the necessary package of documents.

And let the tongue wither from someone who says that you can not do it! In the end, you did not finish the 2 grades of the parish school!

In addition, it is the duty of tax workers to advise on such matters, so please do not hesitate.

-

Banks, customers, suppliers and other "people" with whom you will have to communicate in order to reach unprecedented business peaks are more trusted by a legal entity than a private entrepreneur.

From this directly depends on the size of investment and the size of the sale of goods, services or what you think of yourself there.

-

In case of a complete failure, the participants and founders of the LLC are responsible for the obligations of the firm only in the amount of the property that was transferred as a mandatory contribution.

And consequently, your favorite couch, the broken "penny" of 1989 and even the Romanian sideboard, terrible as an atomic war, will remain with you, so that it does not happen after the registration of the enterprise.

What you need to open an LLC: 5 nuances

Where and to whom to go with the money and documents for the registration of LLC: the first steps on the thin ice of entrepreneurship

Who is the most intelligent?3 methods to undergo bureaucratic "hell" with registration of

- LLC, the founder, clenching his teeth and stocking valerian, independently collects and submits a package of necessary documents;

-

you can come to the services of legal entities-registrars.

Pay the n-th amount of money, draw up a power of attorney on these "wizards" and - voila, - now you are the "big boss" in LLC!

-

to buy a ready-made business, that is already an open company, and not to register a new one.

But in order not to buy a "cat in a poke", we recommend choosing a company no less carefully than a companion / companion of life.

We surrender!4 ways to submit documents for the registration of a legal entity

Documents of future business sharks who decided to register LLC in a tax at the place of business, you can file:

-

personally, coming to the state agency.

At the same time and get acquainted with tax inspectors, to sing with him teas, then solve the pressing problems;

-

send a proxy to register a company.

Do not forget to just decorate this miracle man, which you send "to tear," a power of attorney( notarized);

-

by mail.

We so look, you are a fearless person, if you decided to trust this valiant institution!

All signatures on documents must be certified by a notary, and the letter should be sent by registered mail with a list of enclosed documents;

-

with the help of a special online service https://www.gosuslugi.ru.

Option for the most "advanced".

Price issue: how much will it cost to collect documents and register a company?

You can collect the documents for the registration of the LLC only by storing some amount of money:

-

Photocopies of passports( pages with marks) of all LLC members and their taxpayer identification number, if any.

On each sheet, "in the old-fashioned way", write "Copy is true" and sign your name;

-

A receipt that confirms that you paid the state fee.

Those most obligatory for LLC 4000 rubles, about which we wrote above. The bill for payment can be taken in the tax inspection or formed independently, by clicking on the link service.nalog.ru/gp2.do.

- Minutes of the meeting of founders( if there are several of them)( sample document - http: //firmograd.ru/content/view/32/93/) or decision to create LLC, if you and one in the field warrior( sample document - https://www.malyi-biznes.ru/registraciya-ooo /dokumenty/reshenie/);

-

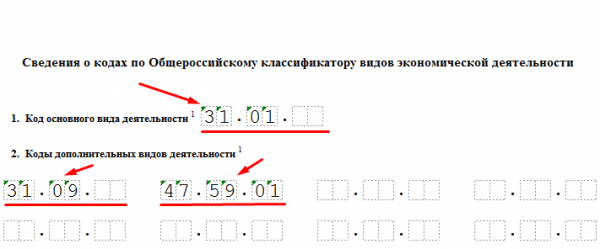

New( from 2016) OKVED.

You will need it only in order to select the codes of the types of activities that you are going to deal with and indicate them in the application. We advise you to write more and more, even what you plan to do in the future, because there are no restrictions on the number of KVEDs;

-

A copy of the document that confirms that you have a "head bow"( legal address), that is, a certificate of ownership of the premises or a lease with a guarantee letter.

In documents as the legal address of the company, you can specify at least your dacha, at least the mother-in-law's apartment, if she does not mind and gives written consent;

- An agreement on the establishment of an LLC is necessary if the founders are more than one( "How many swords do we have?"), But since 2009 it is served at will, but not necessarily( sample document - http: //www.buxprofi.ru/information/ obrazec-dogovora-ob-uchrezhdenii-OOO);

- Statement in the tax that you go to the special regime of taxation, for example, simplified if it is necessary( USN, UTII, ESKH), otherwise you will be transferred to the general system of paying taxes;

-

Charter of your LLC in 2 copies.

From 2017 to treat the desired, but not mandatory documents when registering LLC in the state agency( sample document - http: //www.buxprofi.ru/information/ obrazec-ustava-obshhestva-s-ogranichennoj-otvetstvennostju);

-

Documents confirming that you have "thrown off" on the authorized capital of the LLC, if your inspector is very harsh( an act from the bank, if you paid money to a settlement account or an act of transferring property, if you contributed your part "to everything that is overchargedwork ").

Until the registration of LLC documents, at least 50% of the authorized capital must be contributed;

-

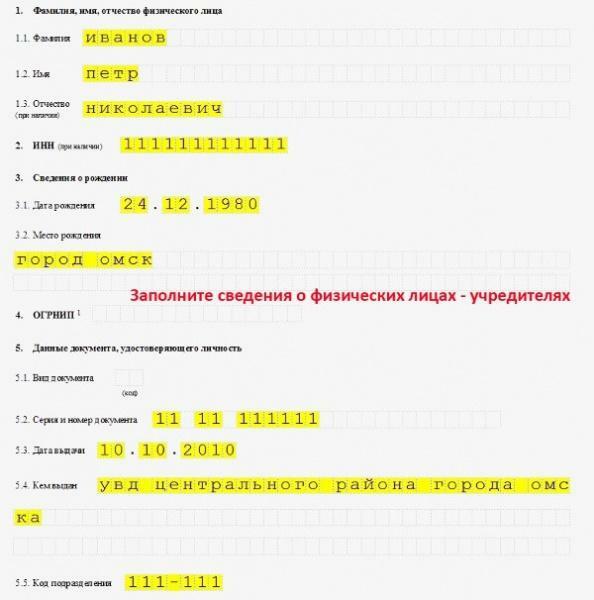

Notarized application( Form P11001).

When completing this important document to register an LLC, you must remember:

- form is filled in by the founder( or one of the founders) or the head of the firm( director), if he has already been appointed by the order;

- application for registration LLC consists of 24 sheets, but do not be afraid - you need to sweat only over 9-13 pages, the rest is filled in by the tax inspection;

- to fill this "letter of happiness" for registration can be either manually( only in black), or in special accounting programs or state online service;

- all letters and digits do not fit in any way, but in specially allocated boxes( font - 18, Courier New);

- the name of your business offspring( LLC) when registering you need to write without hyphenation. So do not worry, remembering the school spelling!

- when printing any documents for the registration of the company, including applications, do not allow duplex printing. Fully you, do not be rude, a couple of sheets of clean paper will not save you from financial ruin!

- words are shortened, if necessary, in the usual way, according to the well-known rules of the Russian language, and no dashes are placed. So do not be original - tax inspectors will not appreciate your talents;

- blank pages of the application for filing for the registration of LLC do not need to be notarized and hand over;

- if you do not have an INN( individual tax number), do not be sad! Just do not specify it when registering in LLC documents;

- after all the data in the application are made, do not be lazy to go to the tax so that its employee has indicated to you the "jambs", if any;

- when received "good" from the inspector, you need to go to the notary. Before the certification of your documents for the registration of the company, he will number and thread them.

What is a business plan and how to compile it?

What is a settlement account and how to open it?

| No. | Name of service | Cost, RUB |

|---|---|---|

| 1 | Registration LLC( State duty) | 4000,00 |

| 2 | Opening of current account | 500,00-1500,00 |

| 3 | Printing production | 300,00-1000,00 |

| 4 | Lease of registered office | 1500.00-5000.00 |

| 5 | Expenses for notary public | 800,00-1500,00 |

| 6 | Services for third-party registrars | 2000,00-8000,00 |

| 7 | Entering share capital( minimum) | 10000,00 |

10 steps to paradise: the list of compulsorydocuments for the registration of LLC in 2017

If "There is nowhere to retreat - Moscow is behind us!", then for registersation Ltd. prepare such documents:

How to live on?6 things that need to be done after the documents for registration of

LLC have been submitted After you noted the delivery of documents for registration of the LLC to the tax inspection, you should:

-

After 3 working days, pick up such papers in the state body:

No. п \n Document 1 Certificate of incorporation 2 Extract from EGRUL OKVEDET 3 Copy of the company's charter with the tax identification 4 Certificate of registration - Verify that the tax documents issued by her after the company's registration do not containshib and typos , otherwise they will be corrected for your money, and you can become instead of Alexei Andrey, and your LLC will turn from "Zakal" into "Zakolka".

-

Open a checking account in any bank you like if you have not done so before.

We recommend you to choose not according to the length of the legs of the girl at the reception, but according to the cost of service, reliability and convenience of Internet banking.

-

Order printing in a specialized company. Yes, yes, gentlemen, it's all so serious now!

-

"I do not care" about the fact that you need to register with the Pension Fund and the Social Insurance Fund.

Tax authorities are obliged to notify them about such a wonderful event as the opening of a new LLC.

-

Start accounting.

And you will do it yourself or hire a specialist - it's up to you. We will only say that the variant with a crinkly two-part leaflet( "Incomes" and "Expenses") will not work!

How to start a business without starting capital?

What mistakes do entrepreneurs make when they open an LLC, and how to avoid them?

Answers in an interview with the director of accounting service

That's all the main points related to the filing of documents for the registration of .

We hope that this paper red tape will not frighten you from opening your own business, because it is only a small obstacle to the successful career of an entrepreneur, which you must overcome with ease and grace.