Register an IS in Moscow - a simple matter, but troublesome.

The decision of this issue will take you some time, as well as finance - to pay the state fee.

It should be noted immediately that this guide will only consider how to open the IP in-house.

Of course, you can apply to a law firm, where for a fee( from 3000 rubles.) Experienced professionals within 1-2 days will issue everything "turnkey".

But is there any sense in this if you register the IP independently by everyone?

It is better to put this money aside for the development of future entrepreneurship.

Examine the manual we prepared, and you will not have questions about this process.

With what it is necessary to be defined before opening an IP in Moscow?

The idea of business is not the only thing that needs to be defined before registering a PI in Moscow.

At the very beginning you should find the appropriate codes for OKVED and the taxation format.

It is not so easy to understand a newcomer "on the go", so take enough time to carefully study the following sections.

Then the choice will be made easy, and you will avoid possible negative consequences.

We select codes by OKVED to open IP

The wording "code according to OKVED" sounds officially and a little frightening.

In practice, everything is extremely simple: any type of activity that an entrepreneur can open in Russia has its own code.

They are used for systematization and are necessarily awarded to each PI upon registration. OKVED is a document in which all these codes are collected.

When you have decided what you want to register, you need to find the code that will correspond to this lesson.

Warning! Previously, everyone used codes from OKVED-1.The state for several years "threatened" to start a new classifier, but the decision was constantly postponed. But from 11.07.16 OKVED-2 was still launched. When you decide to open an IP in Moscow in 2017, take the information only from there!

You have to determine the main code, but not necessarily the only one.

On average, for IP it is enough to specify 5-10 codes.

Do not go too far and write out a hundred pieces "in reserve."

Subsequently, they can still be changed.

Find the code you need here: http: //xn-2-dlci2ax1i.xn--p1ai/ or here http: //okved2.ru/.

Choosing a taxation system to open an IP

The second thing to think about is the future taxation system.

Let the solution of this question seem to you the most difficult step.

Do not let things slide!

You are the owner of this business, and you should be aware of all the subtleties of how to register it, and how it will work. By choosing an inappropriate tax system, you will provide yourself with a headache.

And "scoring" for paying taxes at all - fines and penalties.

It is worthwhile to know that if you decide not to open an IP, you will not make a choice in favor of one or another form of taxation, then you will end up in the OSHO.

This taxation format is a dark forest, especially for beginners.

So be prepared for the decision to register the IP in advance. Estimate the three most popular IP taxation systems:

| System | Features |

|---|---|

| USN 6% | One of the most popular forms, the so-called simplified. The entrepreneur pays 6% of the profits + in the PF and the FRIFF. |

| USN 15% | Another simplified version. The difference from the previous one is that the IP pays a percentage not from the money received, but 15% of the amount that is obtained from the equation "income-expenditure".Additional contributions are the same as in the USN 6%. |

| UTII | Single tax on certain activities. If you describe briefly the system: you pay a fixed amount for doing the statutory activity for this form of taxation. The list includes household, automobile, veterinary services, some types of retail trade. More information on the FTS website: https: //www.nalog.ru/rn77/taxation/taxes/envd/. |

For updating information, please follow the FTS website: https: //www.nalog.ru/rn77/taxation/ tax_legislation /.

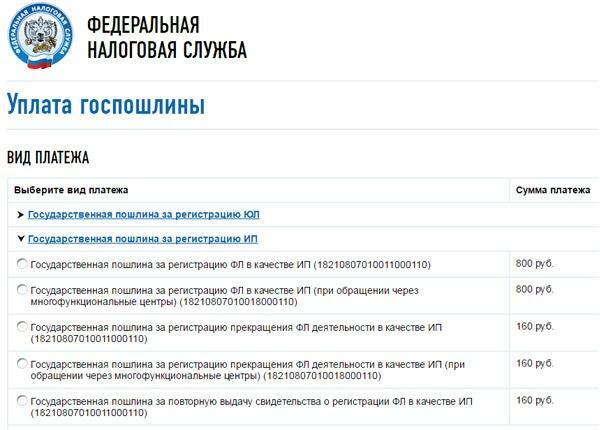

Step 1: Payment of state duty in Moscow

When you have sorted out the theoretical information, you can proceed to practical actions.

The first step before( !) How to file documents to register an IP in Moscow is payment of state duty.

The receipt on which you will pay the state duty, search on the site of the Federal Tax Service: https: //service.nalog.ru/ gp2.do

With the help of the service you will form a "payment", with which you go to the convenient branch of "Sberbank" in Moscow.

The amount is small - 800 rubles. The document of payment, of course, save - it will go into the package of securities to register the IP, which you will carry in the Federal Tax Service of Moscow.

Step 2: Choose where and how to submit documents in Moscow

There are 4 options for filing documents to register an IP:

| Personal visit to the Federal Tax Service in Moscow | The most popular and recommended option for us. Find the address of the inspection, which corresponds to the place of your registration, on the site of the FTS( list in Moscow - https: //www.nalog.ru/rn77/ apply_fts / # t1).Clarify the time of work, and go there personally. You can also transfer papers through a representative( only by proxy). |

| Submission to the MFC in Moscow | Multifunctional centers - an alternative to the Federal Tax Service. Addresses and work schedules are available here: http: //mosopen.ru/goverment/group/ 52. |

| Sending of mail by | Not everyone has a place of actual residence in Moscow that coincides with the address of residence. If you can not come to the necessary branch personally, you can send a package of documents by mail. To do this, use registered letters, always with a description of the content. The address of the inspection is here: https: //service.nalog.ru/ addrno.do. |

| Filing on the Internet | The state keeps pace with the times, therefore it provides the opportunity to register IPs via online service. Detailed instructions and a link to the relevant section of the FTS website: https: //www.nalog.ru/rn77/service/ gosreg_eldocs /. |

Step 3: We create a package of documents to register an IP in Moscow

"We'll put together" all the above instructions, compiling the list of documents you need to open the IS:

- Passport of a resident of the Russian Federation. To send a letter - copies that need to be stitched.

-

If you have an INN, attach a copy of the help.

If not, it will be assigned to you automatically.

- Receipt for which you paid the state fee.

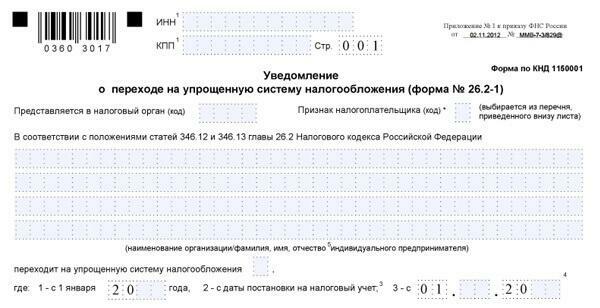

-

Statement that you will work on USN.

Search for the current form of the form in the relevant section of the FSN website in Moscow: https: //www.nalog.ru/rn77/taxation/taxes/usn/ # title3.

Sample form 26.2-1:

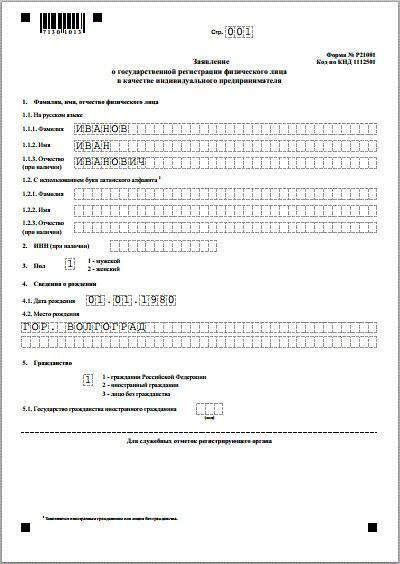

-

Two copies of the statement that you wish to register an IP in Moscow.

Notarized if the paper is sent through a proxy or by mail.

Fill in form P21001: https: //www.nalog.ru/rn77/ related_activities / registration_ip_yl / registration_ip /order/4162994/.

Step 4: The process of submitting documents to the tax inspection

Suppose you have chosen the easiest and most reliable way to submit documents - a personal visit to the Federal Tax Service.

In this case, when the inspector accepts a package of securities, he will give you several important documents:

- Receipt, which confirms the fact of submission of documents.

- Your copy of the application for the transfer of IP to the chosen taxation system( mainly - USN).Let's do it again: do it right away, otherwise it will wait for you.

Check: on the transition instance there should be inspector's marks - signature, stamp with the date of submission.

In the case of sending papers by mail or using the Internet, this step is skipped.

How to close the IP?

Step 5: The final stage - getting papers about registration of IP

After submitting documents, it remains to wait for the result.

If you have transferred all the necessary papers and filled out the applications correctly, in 3 working days you will receive a certificate of IP registration.

You will be given( or sent by mail) such documents:

- A certificate that confirms that you successfully registered an IP in Moscow.

- If you did not have an INN before, a certificate of its assignment will be attached.

- Also in the list of papers there should be an extract from the EGRIP.

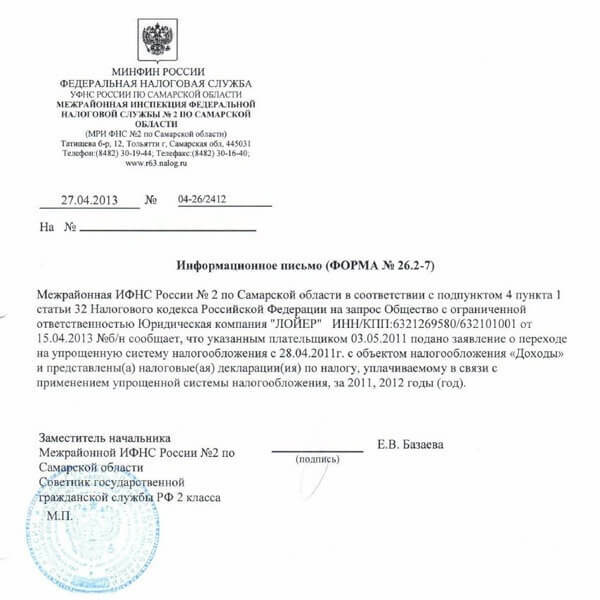

Attentive readers will notice that there is nothing in this list that would confirm a successful transition to the chosen taxation system.

You do not need this kind of paper. You filed the right application at the registration, because the chosen system starts to work for you from the moment of putting the IP on the account.

If for some purpose( even your own repose) you need a confirmatory piece of paper, ask it in the tax inspection.

For this purpose, a letter is prepared according to the established form 26.2-7.

Download the form here: https: //www.nalog.ru/html/docs/ 4010_7.rtf

The tax inspection sends the notification to the Pension Fund independently. The paper confirming that the PI was able to register will come by mail some time after you managed to open the PI.

Save this notice, it may come in handy in the future.

How to close an IP with debts: a step-by-step plan and 5 tips

The most frequent questions for newcomers about how to open IP

Why can I refuse to open an IP?

Indeed, sometimes your IP can be registered. The reason for this is indicated in writing.

Looking ahead, we will note: in 95% of cases the matter is simply in incorrect filling of documents for the PI's opening.

Why is the manual not mentioning the search for a legal address for the IP?

Because it is not needed to register an individual entrepreneur.

Instead of it everywhere on official papers your address of a residence permit will be used.

However, the state does not oblige the employer to use only it. You can open an office and indicate its address on the business cards, website.

To register the PI yourself, please watch this video:

Is it necessary to open a settlement account for the PI's work?

An inquisitive reader who will turn to the law, may notice: the state does not require the IP to open a bank account. So you can do without it?

Indeed, many entrepreneurs use only cash.

Should you refuse to cooperate with the bank? Of course!. .. if you want to add yourself a headache, spend a lot of time on making payments and keep records manually.

And if you are set to work long, and want to optimize all processes, it is better to go to the bank and open an account.

After reading this detailed manual, you should not have any questions, how to open an IS in Moscow .

The only thing that should be added is, keep up-to-date information on the official site of the Federal Tax Service( https://www.nalog.ru), as additions and changes in the legislation occur quite often.