Smart people know that you need to live within your means and buy what you can afford.

And they know that no matter how small your salary is, you need to save at least a small amount of money each time.

Such simple measures will gradually allow you to accumulate enough to cover financial gaps and feel more confident when the universe throws unexpected surprises.

If you follow these simple rules, you will not be in the most difficult moments to think, where to borrow money - you will have your money reserve, which can be used for treatment, home and equipment repair, purchase of something necessary, investment, etc.

But if it so happens that you need money immediately, and you do not have them, you'll have to borrow and better do it wisely.

How to take money in debt: 3 boards

I am against living permanently in debt or on credit, but I have acquaintances who have everything that they have in the house, and even the house, they borrowed.

And, it would be okay to earn a little more and did not have the opportunity to accumulate a sufficient amount.

So no, wealthy people, with quite a decent monthly income, prefer to borrow money from the bank, overpaying almost half the cost of each purchase? What for?

What are they pushing at this?

To answer intelligibly my questions they could not.

If you are thinking how to borrow money, here are some useful tips for you from domestic financiers:

-

Choose a second between debt and collecting.

Debts can only be made when there is an urgent need for money.

An urgent need is treatment, starting a start-up that can not wait, buying heating equipment for a house that broke down in the midst of winter, repairing a broken sewage system, etc.

The new smartphone in return for the still working old phone is a fad that can well wait until you save the required amount.

-

Always borrow in the currency in which you receive wages.

Look at people who ponabrilis dollar debts from banks, and then began to moan that the rate has grown very much, and require that the state allowed them to pay loans at the rate at which they entered into a contract, thus hanging expenses for their whims on their shoulderstaxpayers.

Do you receive a salary in UAH or rubles?

That's the credit in this currency.

-

Do not be lazy to look for the most advantageous option for yourself.

If the issue is not acute( money is not needed immediately), then it is worthwhile to consider the various options and choose the most profitable for yourself.

Yes, it will have to spend a lot of time on it, but it will help to save.

Where can I borrow money without interest?

Of course, every person wants to borrow the required amount of money with the most preferential terms: a long period of refund and no interest rate, so you do not have to give more than you borrowed.

Is it even possible to implement such an option?

Of course, if you have a lot of acquaintances.

Here's who you can borrow money without an interest rate:

-

With close relatives.

Related ties are important for most normal people.

If you have a problem, you need a home or dream of your business, then I'm sure that close relatives without financial problems will help you out.

-

With friends.

That's what true friends need to help out in difficult situations.

If you have such friends, then ask them for a loan, I think it will not be very difficult.

-

Have friends of your friends.

Ask your friends to say a word to you in front of a secured friend or girlfriend who they have.

Just pay the debt neatly, so as not to substitute your friend who interceded for you.

-

I have colleagues.

If you have been working in a team for a long time, why not ask one of your colleagues to borrow money from him?

You can even puzzle a few colleagues if it's a large sum.

-

At the head.

Yes, you did not misinterpret, it was - the boss.

However, in this case, you need to look at who you got to the heads. If some kind of bitch or malicious miser, then it's not worth trying.

But my friends were able to borrow from their boss missing $ 5,000 to buy an apartment.

They gave this amount slowly - 2 years, because the boss did not need anything and did not hurry his young subordinates.

A few rules for those who want to borrow money from their friends, relatives or colleagues:

- Have successful wealthy people among your friends and acquaintances, because if you only deal with poor losers, then there will be no one to lend money.

- Do not be offended if you are asked to give a receipt - there's nothing wrong with that.

- Observe the terms of your contract, even if it was oral, do not delay with a refund.

- Do not abuse friendly and kinship ties, do not constantly try to borrow money from your friends, acquaintances and relatives.

- Do not insist, if you refused to give the required amount. Perhaps this person had his own good reasons for doing so.

What is most important, if you want to borrow money from someone you know without interest?

Your reputation is important.

If you are a human-turd, whom no one likes, then nobody will be willing to lend you.

We see quite a different situation with good people who have always happily helped others.

Before it's too late, become a good person, get true friends and establish relationships with relatives.

So you'll know that you can always borrow money when you need it.

Where is the easiest way to borrow money?

If you are concerned about where to take money in debt, then I'll tell you the simplest and most reliable place.

This is a bank.

Disappointed?

Did you know about this yourself?

So why ask?

Or did you think that I would call you a secret place where everyone would receive money and not even demand a refund?

There is no such place, enough to dream about the unrealizable!

Bank - this is not such a terrible institution, as it may seem at first glance.

Today, lending conditions in financial institutions are quite loyal, interest they offer is relatively small, and the repayment period can be extended for several years( all depends on the loan amount and your income).How to earn money for an ordinary person? Of course, you will have to face certain difficulties if you want to borrow a large amount of money from a bank:

- will have to provide a statement of its income and, if they are too low, you may be refused;

- must wait until all the bank is checked and issued documents;

- can not do without collateral with very large sums, etc.

But all these difficulties are quite solvable, otherwise there would not have been so many people wishing to borrow money from the bank, despite the complexity of issuing a loan and the need to pay for the purchase of more than its real value in connection with the interest set by the bank.

My advice to you: if you decide to borrow money from a bank, then study the terms of lending in each of them in order to choose the most profitable.

When my girlfriend and her husband took out a loan for a car 7 years ago, they personally bypassed all the banks whose offices were in their town, got acquainted with the conditions of each of them, consulted a familiar banker and lawyer.

Only then decided to take a hryvnia loan in Ukrgazbank.

He at that time was lending at 18% per annum( while other banks offered 19%, or even 20-21%).

It seems that 1 to 3 percent is the same nonsense, but let's count:

| Amount borrowed ( in rubles) | Loan term ( per month) | Interest rate | Amount of annual overpayment ( in rubles)) |

|---|---|---|---|

| 204 000 | 12 | 18% | 36 720 |

| 204 000 | 12 | 20% | 40 800 |

Where can I borrow money? Only not here!

You already know where it's safest to borrow money.

But I think that it is simply obliged to warn you not to risk and not get into debt to scammers and dangerous people, no matter how attractive the conditions of their lending at first glance seem.

1. Credit unions.

Even a legally operating credit union is bad in that it establishes predatory interest in comparison with the same banks.

Yes, they can make a loan much faster than in a banking institution, but are you really so rich that you are ready to overpay for your whim.

Think well again if the game is worth the candle.

Some people dream that the credit union will go bankrupt and you will not have to give money.

Do you really believe that people who lend someone a large sum of money can forget about it?

Do not be so naive!

Where to earn a million and is it real?

2. Scammers.

Today, you can find such an abundance of ads in the style of "borrow money without a certificate of income for half an hour," which, frankly, frightens me.

If there are so many proposals, then there is demand for them.

I'm not saying that all creditors who work privately are scammers, but how to calculate an honest person among the abundance of scams?

If you do not know the answer to this question, then why risk it?

And I do not understand why I should apply to some private creditors instead of official banks, when they suggest repaying a debt at an interest rate that is several times higher than a bank.

For example, to borrow money from a bank on a car can be at 18 - 20% per annum, an apartment - at 12%( there are more favorable offers), while private traders set the interest rate at 25%, and often - and more.

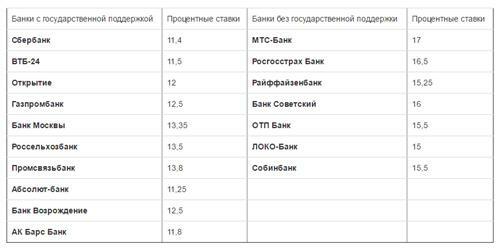

Here, for example, the terms of mortgage loans from different Russian banks for 2016:

3. Crime.

As much as you do not need money, remember that it's more expensive to contact with crime.

Firstly, it is not possible to conclude a legal contract with them and it is quite possible that the conditions for "crediting" will change, that is, you will be forced to give much more than was required at the beginning.

Secondly, think about what will be done to you, if for some reason you can not give away money borrowed from the criminals.

Where can I borrow money and how do I get by without it?

Before deciding to borrow money, honestly answer yourself to the question: "Can I do without it?".

It is possible that you are able to wait six months - a year with a purchase, find an additional source of income and accumulate the required amount.

There are also alternative options for interest-bearing and interest-free loans.

Tip # 1.To rent a house.

I suggest you such a scheme.

You rent your apartment for a year and move to your parents for this time.

Simultaneously draw up a loan for what you need, too - for a year.

Take money from tenants for the first and last month of their residence - that's the amount of the first installment.

And then repay each month a loan out of the money that your tenants pay you.

So you can eat a fish, and do not choke with a bone.

And living with your parents for a year is not such a terrible inconvenience.

Tip # 2.To sell or lay something valuable.

If you really need money, then perhaps it makes sense not to borrow them, but to sell or mortgage to the pawnshop the valuable things that you have.

So you can get the required amount without getting into debt and without thinking how to give this amount.

Yes, of course, it's a pity to sell their values, but it's better than overpaying by taking an official loan.

And, going to the pawnshop, you get a chance to redeem after a while what you so dear.

How to properly borrow money, you will be told the video:

Now you know, where to borrow money , so I hope you will not risk it in vain and do not get involved with swindlers and bandits.