Everything, so on can not continue!

If you really "got tired" of working from salary to salary "on uncle", and in the head - a million bright, like the sky over the Maldives, business ideas, it's time to go to entrepreneurs!

No one will ever tell you what time to go to work and how to "please" a potential customer.

It remains only to find out if is better than PI or ( an individual entrepreneur or a limited liability company) to open, so read our tips and go ahead - to board the harsh world of business!

17 things you need to know about individual entrepreneurship before deciding what is better than IP or LLC?

9 "charms" of IP: small, yes remote.

Before finally deciding that it is better to open a PI or LLC, you need to learn about the benefits of PI:

-

Open the PI by everyone, even if it is not a heel in the forehead, since the procedure is quite simple.

You do not have to give yourself lawyers.

-

Simplified cash discipline.

Believe me, this is very important if you always have "butterflies in your stomach" and "lofty thoughts" in your head, and the need to wither "over gold", like Koschey the Immortal, causes mild nausea.

-

You will not need to pay tax on property that is applied to firms if you decide to open an IP.

And this can not but please the future shark business.

-

Very simple accounting, which even a fifth-grader will cope with, and not that such a "giant of thought and the father of Russian democracy," as you are.

It all boils down to the filling of a single book's IP.

- Taxpayers are less likely to "run into" taxpayers, and after all, tax audit - stress for the body pohlesche than a march-throw for 10 km.

-

A simple and quick procedure for eliminating IP.

And what if your idea of teaching Japanese calligraphy in the village of Barabulkino proves to be a failure?

-

IP can choose a patent taxation system.

paid a clearly designated amount for a patent - and you sleep peacefully, like a child.

-

IP should not coordinate with anybody, unlike the founders of LLC.

Everything, as in the legendary film "Station for Two": "Itself, herself, herself. ..".

-

Tax rates are lower than for LLCs, and their number is lower.

What with IP, orphans such, take it! Whether it's corporate "monsters"!

8 "sunspots": the disadvantages of opening an IP.

Even if you firmly decided that it is better to open an IP and not LLC, you need to know that:

-

You will not be able to receive additional funds for business development from the founders, as LLC does.

Yes, dear, the maximum investment in your flower store is the salary and the husband's bonus.

-

If the IP is in debt, as in silks, then after liquidation it will be necessary for all to answer to creditors, "that is acquired by excessive work."

In the course are apartments, cars and other earthly goods.

-

IP is not very attractive to investors.

For serious uncles in suits from Brioni, as Ostap Bender used to say, "the game class is not very high";

-

IP, unlike LLC, can not be re-registered with another person or sold.

And what if you decide to quit business and go to Jamaica, where it's light, warm and you do not need to work?

-

IP is obliged to pay contributions to the Pension Fund, even if it is in the "minuses" and the profit does not come at all.

And no complaints about irresponsible suppliers, sloppy clients and the Moon in the constellation of Capricorn will not help!

- In case of application of the general taxation system, the FE will have to pay also the profit tax for physical persons.

-

IP must independently "steer" in his company.

That's why it's hardly possible to give up "for a week in Komarovo" without agreement with customers, suppliers and other contractors.

The maximum sloppiness that you can afford, if you decide that it is better to open an IP - to arrange for someone to represent the notary.

-

IP can not "promote" the brand without registration.

Therefore, if you dream at night of the logo of a family bakery and you already see it on kraft bags for fresh baked goods, cups, T-shirts and other souvenir nonsense, or you are ready to put your life behind the slogan invented during the brainstorming session, it's better to open LLC.

What is better LLC or IP: 25 theses about LLC to make the right decision

15 "pluses" LLC for those who are not looking for easy ways and ready to open a full-fledged company

When the head starts to swell from the thought that it is better to open LLC orИП, we advise to know the "bright side" LLC:

-

In case of bankruptcy, the founders of LLC are responsible for the company's debts only in the amount of the contributed share capital.

And this means that with any financial "scenario" your apartment in Khrushchev, "Moskvich" in 1976, and a collection of soldiers will remain with you.

-

An enterprise can easily attract new founders, and hence additional investments.

This should be taken into account if you are going to not just open an LLC to get from bread to water( we believe that your plans are more interesting!), But "to capture the world".

-

You can manage LLC in a convenient way for participants.

That is, they can hire at least thirty directors( for marketing, production and anything), if only the firm would make a profit.

-

The share of each founder of the LLC, and accordingly the degree of its influence when making managerial decisions, may vary.

We, of course, do not encourage you to arrange intrigues in the style of the court French king, but you in LLC will have a legal way to get rid of the "black sheep"( negligent founder) by buying out his share.

-

LLC is easier to attract foreign investors, which will allow the company to function better.

It's time to remember your beloved uncle, a businessman from Israel and a cousin from the States.

- The size of the authorized capital is not limited by the legislation , and therefore, if you are confident in your business idea, like in your beloved wife, you can invest in the firm all means.

-

You can contribute your part of the authorized capital of the LLC not only with money, but with tangible or intangible property.

In a word, drag at least a grandmother's chest and father's dinghy with an inflatable boat, if other founders have nothing against it.

-

To leave the participants, if you open an LLC, you can get your share at any time and within 4 months.

What if you want to escape to Siberia in a half-year or to comprehend the truth with Indian yogis?

-

The director is allowed to appoint a person who is not one of the founders of the LLC.

If the candidacy of the respected Sergei Petrovich suits everyone, then why not?"If only man was good" and a competent specialist!

-

The Charter of the LLC may prohibit the sale( pledging) of its share to the person who is not a participant.

Always dreamed of becoming a member of a prestigious closed club? There's a chance for you!

-

The company has the opportunity to "shamanize" with profit in the way the participants want.

At the same time, it may not be distributed proportionally to the size of your shares.

-

LLC does not pay taxes if its activities are unprofitable, unlike IP.

It is only necessary to prove to the tax inspection that bribes are smooth with you.

-

A firm can cover current losses with past losses.

This means that if you are completely bad, you should only, as Ilya Muromets, "stand for a day, let the night hold out" to pay off old debts.

-

Ltd. are more attractive to potential investors than IP, as there is an opportunity to become a founder.

And who does not want to feel like a big boss and even make a profit?

-

LLC, if necessary, can be sold or re-registered.

So when you decide that it's better to stay at home and plant violets, the way to "freedom" will always be open!

The reverse side of the coin: 10 disadvantages of LLC, which you need to know in order to decide what is better than LLC or IP

. Even if you are firmly convinced that to open an LLC better than an IP, we recommend you familiarize yourself with the "minuses" of this organizational and legal form:

| Registration procedure | A simple registration procedure at the place of residence specified in the passport, without statutory capital, charter and stamp. The set of documents is minimal, the fee is only 800 rubles. | Registered at the legal address after the conclusion of the agreement between the founders and the development of the charter. Registration is impossible without the minutes of the general meeting, bank account and printing. The minimum amount of the authorized capital is 10,000 rubles, the registration fee is 4,000 rubles. |

| Founders of | An individual entrepreneur is the sole owner of a business. | Perhaps up to 50 founders and up to 50 co-founders. |

| LIABILITY FOR | If there are claims from creditors for debts, it answers all property. After the liquidation of the obligation is not terminated. | For the obligations to creditors, the founders are liable only in the amount of funds contributed as a share, the obligations cease after the liquidation of the enterprise. |

| Accounting and tax reporting | If the IP does not have employees, it is not required to keep accounting and reporting( balance sheet and statement of business results) to the Tax Inspectorate. If the enterprise uses USN, only the book of income and expenses is maintained. | LLC is required to maintain accounting records under any taxation system and to provide reports to the Tax Inspectorate, the Pension Fund and the FSS. |

| Profit distribution | The revenue that is available in the bank account and at the cashier can be disposed of freely. | Funds from a bank account or cash register can be taken only for business needs or payment of dividends( no more than once every three months). Since dividends, 9% of personal income tax is accrued. |

| Restrictions on the type of activity | IP can not produce alcohol and sell them( except beer), engage in insurance, banking and tour operator activities, this form is also not suitable for pawnshops. | You can engage in any entrepreneurial activity. |

| Penalties | All penalties are charged to any individual if there is no current account. If the account is, the amount of the fine imposed by the Tax Inspectorate can not be more than 5,000 rubles( without a court decision). IP is an official, therefore the maximum amount of a fine is 50,000 rubles. | Without a court decision, the Tax Inspectorate may impose a fine of up to 50,000 rubles. Administrative responsibility - up to one million rubles. |

| Powers of | Until June 2014, only the owner of the enterprise could represent the interests of the IP.Now it is allowed to issue a power of attorney for signing the accounts, but it does not relieve the entrepreneur of the obligation to sign primary documents. Even if the IP is located in several places, the director can not be appointed. | Business activities are carried out under the supervision of the director. |

| Attractiveness for an investor | IP can only issue a loan( to attract another person as an investor it is possible only after re-registration in LLC). | You can attract any type of investment, including the acceptance of new founders. |

| Employees of | It is allowed to do business without attracting employees. As an employer, it is registered only if there are employees. | Since its inception, it automatically becomes an employer. |

| Opening of representative offices and branches | You do not need to register representative offices and branches. If you expand, you do not lose the right to the USN. | Formation of representative offices and branches requires changes to the constituent documentation and registration of changes. Expansion can not use the USN. |

| Important nuance | IS |

|---|

-

The maximum allowed number of founders of the LLC is 50 people.

Therefore, you should not try to attract all relatives to the company to the fifth tribe and neighbors in the country.

-

It is necessary to amend the documents of the LLC in case of the slightest change in the number of participants or their composition.

It's better for you to hire a lawyer to work in the company to forget about this paperwork once and for all.

-

The procedure for registering an LLC is more complicated than an IP.

But this should not stop those who have firmly decided to go "on the path of war."

-

In LLC, you can not do without compliance with the cash discipline.

So a piece of paper and a pencil to write the cash-in-receipt will definitely not be enough!

- Dividends in LLC can not be paid more often than once in 4 months , no matter how much you want to squeeze something out of your business brainchild.

-

Internal and tax accounting in LLC will have to be conducted under any taxation regime.

Therefore, if you are not friends with numbers, it's time to look through the summaries of accountants on job sites.

-

Finance can "sing romances" at the exit of one of the members of the LLC.

You are so counting on a friend Lesha and his money! It is better to immediately agree that LLC - this is seriously and for a long time.

-

All important economic decisions should be taken at the meeting of the LLC participants and approved by the protocol.

Those who once tried to collect many unrelated people at one time and in one place understand what the difficulty is: one has a morning performance in the kindergarten, the other has a grandmother's anniversary.

Easier to land on the moon!

-

I want - I do not want to, and to pay property tax, unlike IP, it is necessary.

-

The procedure for closing an LLC is much more complicated than an IP.

Therefore, one "beautiful" day to quarrel and run away will not work.

In search of truth: a comparative table for those who can not decide what is better to open IP or

Ltd. It is always difficult for a beginning entrepreneur to make a choice in favor of an IP or an LLC.

See good video tips - and the right decision will be yours!

"All professions are important, all professions are needed. ..": what is better than a PI or LLC depending on the type of activity

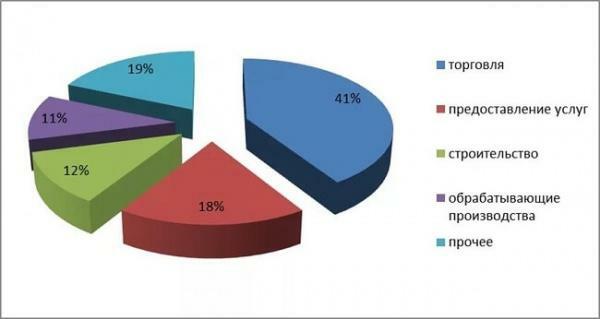

According to statistics, most small and medium-sized businesses in Russia are engaged in trade, various services and construction.

When deciding the question that it is better to open a PI or LLC, it is necessary to consider what you are going to earn on your daily bread:

-

if you are a builder from God and are going to engage in capital construction involving a lot of equipment and workers, then you do not need to guess what is better - IP or LLC, prepare to go through the bureaucratic "hell" with the opening of LLC.

In the same cases, when the construction work is limited to "make up the corners here, we replace the plate", it is enough to open the IP;

-

while you are not going to compete with the trading networks, and your potential buyers are the residents of the nearest houses, then you will also be able to trade the PI for the trade( but only if you did not decide to open a pawnshop or sell alcohol,).

I'll have to "make a fuss" with the cash register and keep a record of the commodity traffic;

-

in the case of a beauty salon, the choice of organizational form( LLC or IP) depends on the list of services provided.

If only a hairdresser and a manicurist will meet a visitor in your institution, then you can do without the fact that you open the PI, but when you are a "Shvets, a reaper and a dude", that is, practice massage in the salon,do other "magic" things with women, which are related to health procedures, then you will have to open an LLC;

-

transport services( for example, taxis) most often "feel" themselves in the IP format( of course, if we are not talking about a fleet of 50 cars and drivers in ties-butterflies and snow-white shirts);

-

for an online store, which is organized by one person, also suitable IP.

Why should you open an LLC if you are going to personally knit your mittens and implement them without leaving your house? You just need to open a settlement account so that customers can easily settle with a wonderful person like you.

In case when the business is organized by several people, it is better to open after all LLC, because "friendship is friendship, and tobacco is apart".

How would you not decide for yourself the question that it is better to open an LLC or IP , entrepreneurial activity will require from you an uncommon willpower( the boss then does not have to work above his head), optimism( and how without it, if every daybegins with the phrase "Chief, everything is lost!") and a frenzied belief in success.