The article will deal with a very specific and complex business or profession.

We'll start with who brokers are, what they do, and what place they occupy in the market. And also we will indicate what kind of knowledge you need to have in order to become a successful broker and what character traits you need to develop in yourself.

Next, you will learn what types of exchange activities are, and what specific work they assume. Then we will spend time organizing the issues of creating your own business.

In the end, we will consider as becoming a broker of , attracting a large number of customers.

So, let's go!

Who is a broker and what does he do?

A broker is an intermediary between a buyer and a seller, in some cases a representative of one of the parties.

The term "broker" can mean either a person or an institution, a legal entity or an employee of a company.

As the word is very capacious, it is impossible to talk about all its aspects within this article. Let us dwell on the most significant.

Here are some areas of brokers:

- Bidding on the stock exchange.

- Insurance.

- Loans.

- Real Estate.

- Customs.

As you can see, the directions of the broker's work are very different, and each has its own specifics.

It is worthwhile to consider the main ones separately.

If you are just thinking about how to become a broker, the information below will help you decide on a niche.

How to become an insurance broker?

The insurance broker is the intermediary between the insurance company and its client.

Basically it is understood that this is an independent structure that provides the client with information services about insurance companies and their offers, assistance in preparing documents and drawing up contracts.

But it happens that a broker is a representative( agent) of one company. Usually, this is an individual who is not registered as an IP or UL.

Who and why does he contact an insurance intermediary?

- People or legal entities that are limited in time, who once had to understand the intricacies of choosing an insurer and the necessary package of services.

-

People or legal entities who doubt the reliability of the insurance company.

After all, insurance involves investing money, sometimes for a very long time. They refer to the mediator as an independent expert in this field.

What are the qualities of an insurance broker?

- Sociability.

- The ability to persuade.

- Good memory.

- Analytical mindset.

- The broker must constantly study and study the insurance market.

How to register an insurance broker company?

In accordance with Russian law, an insurance broker can be registered as an individual entrepreneur or a legal entity( LLC, CJSC, JSC).

The system of taxation for an insurance intermediary can be chosen simplified, basic or UTII.

Pay attention to the fineness of the organization of the insurance intermediary:

-

The name must contain one of the following words, phrases or their derivatives: "insurance," reinsurance "," mutual insurance "," insurance broker ".

You can get acquainted with the list of names of existing companies here: http: //insurancebroker.ru/ reestr-strahovykh-brokerov

- PI or the head of UL must have a higher education and work experience as head of insurance for 2 years.

- The firm must necessarily have a chief accountant with the appropriate education and experience in working with finances in the insurance company from 2 years.

- On the account of PI or UL should be from 3 000 000 rubles for financial guarantees( since you are dealing with the client's money).

- Applicable codes OKD:

However, before entering the codes in the registration form, double-check the information - it is in the process of changes. Since January 1, 2017, OKVED-2 entered into force: http://okved2.ru

The insurance broker is controlled by the Central Bank of the Russian Federation with respect to preventing the laundering of money.

For licit activities it is necessary to obtain a license. It is issued by the Central Bank of the Russian Federation.

The registration procedure takes up to 30 working days and costs 7,500 rubles.

Many useful information on how to become an insurance broker can be obtained from the Association of Insurance Brokers http://insurancebroker.ru

How to become a credit broker?

A credit broker performs intermediation between a bank or another creditor and a client( borrower).

Namely, it can:

- provide information services about banks and their conditions for issuing a loan;

- advise how to obtain consent to issue a loan or reduce the rate;

- to assist in the preparation of documents;

- confirm the acceptability of the contract for the borrower( because the loan agreement sometimes takes a dozen sheets, and it's quite difficult to check it for the common man);

- draw up contracts on behalf of the bank.

Who is looking for a loan intermediary?

- People or legal entities, limited in time, who once had to understand the intricacies of choosing a bank and a suitable loan, deal with the execution of documents.

- People whose credit history is spoiled or their official income is too small to receive a loan.

- People or legal entities that require an impressive loan size, and they doubt the acceptability of the contract.

- People who make out a mortgage.

What qualities should a credit broker have? The same as the insurance broker( listed in the previous section).

How to register a credit broker company?

If you want to become a credit intermediary, and read the entire article, we dare to assume: you were frightened by the requirements for registration of an insurance broker.

We hasten to please - there is no specificity in registration of this type of activity.

And with respect to all issues, the scope of loans is the easiest to become a broker. You need to decide on the form of organization - IP or YL.To start the activity of the broker the IP is suitable.

However, if the plans for rapid expansion, it is better to immediately issue an LLC, so then not be distracted by reorganization.

The choice of tax system is also not limited. Traditionally, we recommend a simplified system.

Please note - in connection with the broad definition of the word "broker", there may be problems with the choice of OKVED code.

We offer the following codes:

However, before submitting documents to the registration authority, read the codes yourself or contact a specialist.

How to become a credit broker, you can find more in the video:

How to become an exchange broker?

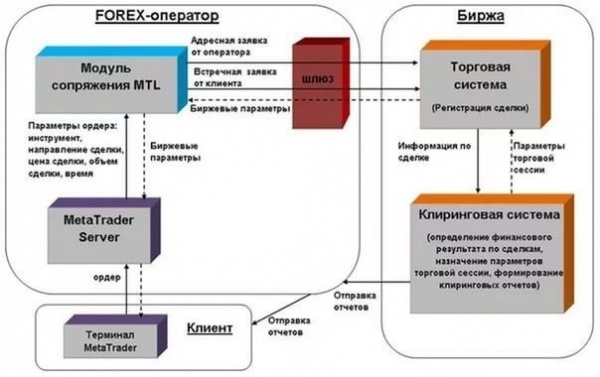

An exchange broker is an intermediary between a trader( client) and a financial exchange.

The situation is that a trader can not trade on the stock exchange. The broker has access to trading on the exchange, and part of this access is sold to the trader.

A trader can act as a private person, and the company. The client and the mediator are connected through a server.

Usually, the intermediary provides the trader with a trading terminal with special settings, which allows you to connect to the exchange server. Sometimes a broker himself performs all financial transactions on behalf of a trader.

So, the broker can provide the client with such services:

- access to trading on the financial exchange;

- advice on bidding;

- providing data for a "glass of applications";

- trades on the stock exchange on behalf of the trader;

- tax agent - calculation and payment of taxes of the trader.

Individuals or companies apply to an exchange broker to invest money and receive profits from them.

What are the qualities of an exchange broker?

The work of the exchange intermediary is extremely stressful and active.

In this regard, in order to become a successful broker, you simply need to have the following qualities and skills:

- stress resistance;

- "cold mind";

- ability to concentrate for a long time;

- the ability to collect and analyze information;

- be constantly aware of all the nuances of the financial market;

- be able to make decisions in a very short time.

How to register a brokerage company?

In the state bodies of the exchange broker it is best to register as an OJSC or a closed joint stock company.

This recommendation is due to the fact that the broker operates with large amounts of money and constantly takes a certain risk.

In case of the worst outcome of the situation, YLL risks losing its charter capital and property, while the IP is responsible for all its assets.

You can choose a simplified system for the exchange intermediary.

The OKVED code for activity is 66.12 - "Brokerage activity on securities and goods transactions".

However, by submitting documents to the registration authority, specify the code yourself or contact a specialist.

What is necessary to get started as an exchange intermediary?

- Get a license( where and what - read below).

- It is also necessary to have money in the bank account in the amount of 10 million rubles, depending on the specifics of the activity.

- The future broker needs to undergo the appropriate training.

There are many types of licenses for the exchange intermediary, here are the main ones:

- for conducting brokerage activities;

- for conducting dealer activities;

- on the activities of securities management in the stock market.

There are a lot of organizations licensing and supervising the activity of stock exchange brokers. The conditions for obtaining a license are different for them.

This topic deserves another separate article. Therefore, we simply advise: to take the choice of a licensing company very seriously, since this will determine the credibility of your firm.

If you want to know how to become an exchange broker, pay attention also to the following information:

- The activity of the stock broker is very tightly controlled and verified.

-

The most famous and impressive in Russia company that issues licenses to exchange intermediaries is the Federal Service for Financial Markets.

It is subject to the state.

- The license is unlimited, however, under any violations it can be withdrawn.

The video contains quite interesting information about

on the structure of the stock market:

How to become a Forex broker?

Forex is an international currency market. In Russia, speculative currency trading, marginal trading is implied by this term.

How to register a Forex broker - 4 steps

-

The main feature of how to become a Forex broker is that a company needs to register abroad.

There are certain nuances in this issue:

- The cheapest option is to register a broker where Forex is not regulated. For example, in the Marshall Islands, etc.

- A more expensive way - where Forex is regulated slightly, reduced requirements. This is Malaysia, the Seychelles.

-

The most expensive - the EU countries - Bulgaria, Cyprus, etc.

Here you will get access to serious customers and low commission. But this way is suitable only for large brokers that have already taken place.

Registration costs from $ 2,000.

-

Next, you need to open an account of an intermediary in a bank, also foreign.

The choice of a specific company for this depends on the place of registration of the company:

- For a cheaper option, for example, institutions in Georgia and the Czech Republic.

- For the second - Malaysia, Belize, Seychelles.

- For the third - European banks.

The cost of opening an account also starts from 2 500 $ .

-

The next step is to create a site.

And this is a very crucial stage, as the site for Forex broker is very specific and functional.

A good site can only be done by someone who understands the nuances of trading in Forex and knows what tools are needed for this.

The price of the site is up to 30 000 $ .

-

Then you need to decide on the choice and purchase of the trading platform for the intermediary. It provides programs for work.

Here are a lot of suggestions:

- The most popular and expensive - MetaTrader4 - will cost approximately $ 100,000 .

- Analogs are cheaper - UTIP, Jforex and many others will cost from $ 5,000 .

- Sometimes you also need to pay a monthly subscription fee. Pay attention to this point when choosing a trading terminal.

In the next video, the author compares the stock exchange with Forex.

We are looking to view, brokers will be interested to hear his point of view:

How to become a high-income broker?

In this article we covered four main types of broker companies. They are very different and, accordingly, different approaches to doing business.

We have tried to collect a number of tips that will suit the broker in any field of activity:

-

Personal circle of acquaintances.

When a person is familiar with the broker in person, he at the psychological level trusts him much more than an outsider, even a professional.

Communicate with a close circle, look through the phone book, social networks.

Use every opportunity to create at least a small customer base, which will further develop itself by means of "word of mouth".

Undoubtedly, the quality of the services provided should be irreproachable.

-

Presentations.

If in a circle of personal acquaintances the percentage of sales is high enough, then the situation becomes worse when communicating with strangers.

For this reason, communication with each individual is an ineffective waste of the most important resource - time.

It's much better to conduct a presentation to a group of people at once.

-

Likbez.

It is better to present the presentation and other group events not as a salesman, but as a teacher.

You are doing a useful job for people, for this they become more loyal. Here you can also remember about your services.

- Presentations, lectures, seminars can be conducted not only with "live people", but also organize webinars.

-

Paid advertising of your site through search engines is the most selling.

And it starts working right away, unlike website promotion in the top-method is also effective, but it takes a long time.

-

The right advertisement in social networks is also a great thing.

But here it is important to address specifically to the target audience, and not to all in a row, correctly picking up the place of advertising.

Of course, if you are seriously interested in the question, how to become a broker of - reading this article will not be enough. We just outlined the main points of the mediator's work.

Actually, in order to create your own business in this area, first of all, personal experience and knowledge is necessary.

For trading on the exchange and forex will require large capital investments.