In connection with the events in the East and Crimea, the President of Ukraine in 2016 expanded the sanctions list in relation to Russian companies by banning the activities of some Russian payment systems in our country.

Many people connected with relatives, workers and other relations with both states had difficulties how to transfer money from Ukraine to Russia and vice versa.

Indeed, in connection with the President's decree, the alternatives became smaller, and the procedure itself became more expensive, but this does not mean that the options for money transfer have completely disappeared.

How to transfer money from Ukraine to Russia with the help of a bank?

Let the Russian payment systems be banned from us, but some of the banks of the neighboring country continue to operate.

In addition, there are international banks and financial institutions operating in the territory of most CIS countries, so nothing prevents you from taking the chance to make a bank transfer of money from Ukraine to Russia and vice versa.

If you often make money transfers between two countries, it is best to issue plastic cards in a bank that operates on the territory of Ukraine and Russia.

The transfer between the cards of one bank is quick and worth a penny.

If, for some reason, there is no way to issue cards, banks offer other options for transferring money.

How to save money?

1. PrivatBank

This is one of the most popular and advanced banks in Ukraine, which has representative offices in 5 CIS countries, including Russia.

Over 50 branches of PrivatBank operate on the territory of the Russian Federation, and in our country there are a lot of them.

PrivatBank offers several types of money transfers from Ukraine to Russia, but, perhaps, the most reliable and inexpensive is:

-

PrivatMoney.

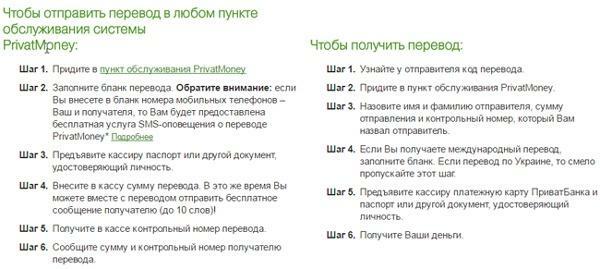

Here is the algorithm of actions you need to commit to transfer money:

The cost of this service depends on the amount you want to transfer.If you transfer dollars or euros, you will have to unfasten the PrivatBank commission, according to the tariffication on the plate:

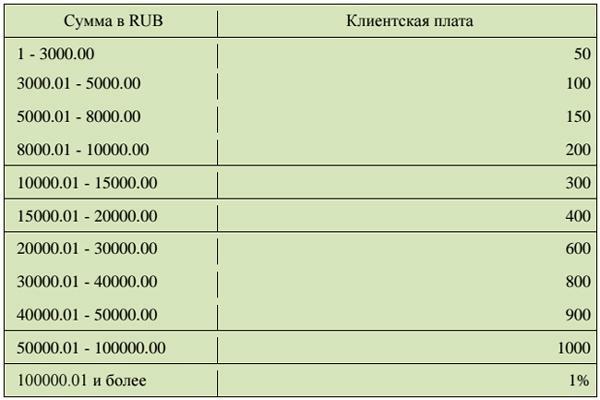

If you make a transfer in rubles, the tariffs will be as follows:

-

MoneyGram.

To transfer money from Ukraine to Russia through the PrivatBank branch, you need to perform the following algorithm of actions:

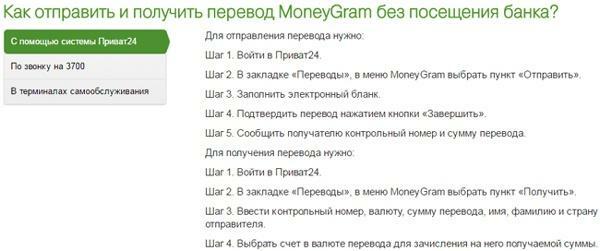

If you are an online banking user Privat24, then you do not even need to visit the bank branch, you can make a money transfer without leaving home, Here is the scheme:

Tariffs for MoneyGram transfer are not that big:

2. Sberbank

This Russian bank successfully operates on the territory of Ukraine.

There are a lot of branches in the Russian Federation, therefore, using the services of Sberbank to make a transfer, you will save time for the recipient.

Sberbank offers to transfer money from Ukraine to Russia in three ways:

-

MoneyGram.

With this payment system you can only transfer dollars or euros.

The fee for services depends on the amount: if the amount is less than 125 USD / EUR, the bank will take 2.5 USD / EUR from you, if more - you will have to pay 2% of the transfer amount.

The maximum limit is 10,000 dollars and 7,000 euros.

-

Western Union.

This payment system is one of the most popular in the world.

Sberbank offers its customers to take advantage of it.

In just 15 minutes, you need the receiver to become the owner of the amount you sent him. Commission - from 5 dollars.

-

SWIFT.

The main advantages of this payment system is that it:

- is fast;

- inexpensive;

- does not limit you in the types of currencies;

- is available not only to individuals, but also to legal entities.

More details about it you can find on the website of Sberbank: https: //www.sberbank.ua/remittances/view/4/.

3. Raiffeisen Bank Aval

This bank offers its clients to transfer money from Ukraine to Russia and vice versa with the help of the international payment system Unistream.

Full information about it can be found on the official Raiffeisen website: https: //www.aval.ua/ru/personal/everyday/ money_transfers /unistream/.

With the help of Unistream you can transfer dollars, euros and Russian rubles.

The commission charged by the bank depends on the amount: from 0.95% and more.

Only individuals are available.

The algorithm is simple enough:

Postal transfer money from Ukraine to Russia

I will say at once: postal money transfer is more expensive than banking, and we all know how "patient", "sympathetic" and "polite" employees of UkrPochta.

And yet you need to know an alternative version of bank transfer of money, especially, given the tense relations that are observed today between our countries.

If you send money by ordinary postal order, then the recipient will have to wait at least 2 days for them, but using modern electronic payment systems, you will make someone happy in the Russian Federation with money in 15-20 minutes.

One of the main disadvantages of a money order is the amount of UAH 15,000( including the equivalent in another currency), which is limited by the National Bank of Ukraine, therefore it will not be possible to transfer large amounts through UkrPost.

As far as tariffs are concerned, they range from 2 to 6%, and, the smaller amount you are going to transfer, the bigger the commission will require UkrPochta.

For example, transfer up to 500 hryvnia, pay 6% of this amount, but if you want to make a larger transfer of money from Ukraine to Russia( from 2,000 hryvnia and more), then pay a commission at 2% of the amount.

Going to UkrPocht, do not forget your passport, but still have patience: most likely, you will have to defend a long queue and experience all the "charm of service" that UkrPochta cashiers have had unchanged since the USSR, no matter how many years thiscashiers: 50 or 25. 🙂

Money transfer from Ukraine to Russia: other systems

There are other payment systems with which you can transfer money from Ukraine to Russia and vice versa.

These services have enough advantages because they are represented by a large number of branches in the states of the former USSR, employ extremely polite cashiers and simplify the procedure to the maximum, so it takes a minimum of time. More precisely, numerous services existed until October 2016( just then P. Poroshenko issued a decree prohibiting the operation of such payment systems as the "Golden Crown", "Leader", "Kolibri" and others).

But you can still use it to transfer money by a payment system such as CONTACT - it is still successfully operating in the Ukrainian market.

How to multiply your money?

1. CONTACT

This payment system has been working on the market since 1999 and during this time it managed to acquire a lot of branches in different CIS countries and abroad.

Only in Kiev there are 248 service points, but CONTACT offices are in other cities, for example, in Cherkassy - 15, in Sumy - 12, in Lviv - 49, in Mykolayiv - 20, etc.

Here you can find https://www.contact-sys.com /where/list/0/map/804/0/ as close to your service point as possible.

The procedure is simple: you come to the branch with a passport, say how much you want to transfer in rubles, dollars or euros, pay a commission( it depends on the amount) 1 - 1.5%, get the transfer number and inform the recipient.

If you do not want to go to the service station and stand in line, CONTACT offers you other ways to transfer money:

- payment terminal;

- Internet banking;

- CONTACT account;

- mobile translation and so on.

How to transfer money from Russia to Ukraine using WebMoney?

Generally, WebMoney is not the only system of electronic money, there are others, for example "KIVI", "Yandex. Money", etc.

But it is WebMoney that is the most reliable, easy to manage and widespread payment that is used by many people all over the world.

The main clients of WebMoney are Ukrainian freelancers who work on the Russian freelance exchanges on the Internet: Etxt, Advego, text.ru and others.

Each freelancer has his own virtual wallet, to which he receives electronic money from customers.

From the account of the exchange, money is withdrawn to the ruble or dollar( the most common variants) of the WebMoney purse, and then transferred to a bank account or spent on purchases on the Internet.

Here you can register on the WebMoney web site with this link https: //start.webmoney.ua/? Lang = RU.

Be sure to issue a certificate( no lower than the formal level), otherwise you can not convert electronic money into real money, that is, to withdraw it to a bank card.

The interface of the resource is as simple as possible, so you can easily figure out how and what to do to register, add wallets that you need, get a certificate, etc.

Translate Russian electronic rubles or American electronic dollars into real Ukrainian hryvnias, for example, on a PrivatBank card using various resources.

| The name of the exchanger | Link | Give WMR( electronic rubles) | Get the real hryvnia | The commission amount( in WMR) |

|---|---|---|---|---|

| Exchange.yas | https://obmennik.ua | 100 | 40,42 | 0,8 |

| Exchange.yas | https://obmenka.ua | 100 | 41,55 | 0,8 |

| E-Dengi.org | https://e-dengi.org | 100 | 40,9 | 0,8 |

There are other exchangers, but those that I called you, the most simple to manage and reliable.

I used it myself, that's why I recommend it.

Naturally, the exchange rate will change, therefore, perhaps tomorrow for your virtual rubles you will get more or less Ukrainian hryvnia.

How to send money from Ukraine to Russia using the Yandex. Money service, see in the video:

I think you saw that there were enough opportunities, how to transfer money from Ukraine to Russia and vice versa, despite the ban on some Russian payment systems.

You just need to figure out the options in detail in order to choose the best for yourself.