Learning to save money. How to start saving, how to collect for an apartment, a car and other large purchases.

Contents

- The most effective ways how to save money

- How to save money for a teenager, a student? How to save money for a student?

- How to save money without work?

- How to save money for a car? How to save money for a house?

- Video: How to save money - save up for an apartment, a car?

- Video: How to properly save and save money from the point of view of psychotechnologies?

- How to save money for repairs?

- Video: How to save money?7 simple rules

- How to save money in a bank?

- How not to spend the accumulated money?

- How to save money: tips and feedback

- Video: How to save money for yourself?

Save, save, collect money. What associations do you have with these words? Most likely, negative. Yes, there is an understanding that all these words are connected with the collection and augmentation of means, but there is something negative inside. Why? It's simple, the media has worked well with us.

From the very beginning to the same. It's impossible not to remember the funny animated series "Duck stories", cheerful and fervent kids, and the mean Scrooge McDuck. Yes, yes, in our minds forever sat negative image of Scrooge so loving his money. And this is only one of the many components of a large iceberg that grinds our consciousness.

Thrift is a virtue, not a drawback

Thrift is a virtue, not a drawback The TV, the Internet, bigboards - all are calling not to be a miser and spend your earned money faster and more fun. And with the advent of social networks, we started to push ourselves towards such actions - every day someone from numerous "friends" spreads photos from restaurants, clubs, resorts, and also with beautiful travel.

And a little more tape is sure to lead away a quote like this "What's the difference in what you sneakers, if you walk the streets of Paris."Beautiful, tempting and so inspiring. And at home life, at work is hard and boring. .. how then will not yield and not give up on the very Paris?

Media work

Media work Thus, today our nation is fundamentally different from its predecessors. Who now has a credit card - yes, everyone. And who has the deposit? Not everyone.

Did you know that our parents did not know what a loan is, installments, etc. In order to buy something, you had to first collect a sufficient amount. And while they bought cars, built houses, cottages, went to rest. Did you earn more? No. Disposed of the budget.

Distribution of income

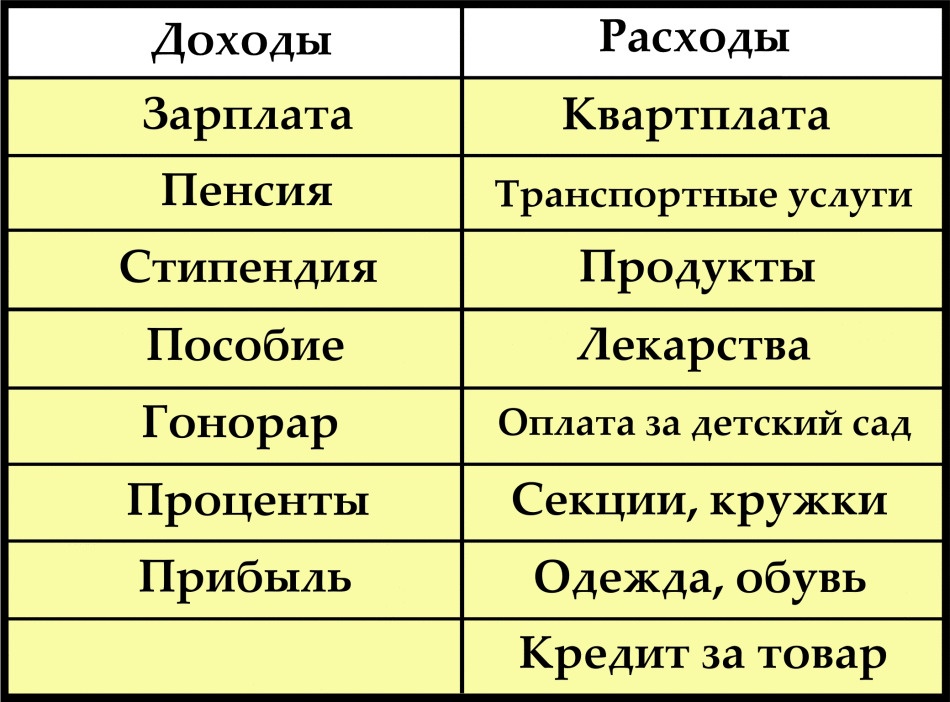

Distribution of income In order to start collecting money, you need to stop chaotically spending money and begin to keep the budget. You need to understand how much you have left, whether there is an opportunity to cut expenses in one area or another.

Income-Expenses

Income-Expenses We give examples. If you think in advance of the menu, buy everything in advance and strictly on the list, the cost of food will be reduced to 40%.At the same time, this does not affect the quality of food. For example, your family likes sweets. They can be purchased at the store every day, and you can think through the menu and prepare useful and delicious casseroles, charlottes, rolls and much more.

Strict account of

Strict account of By adjusting the food, harmful products are naturally excluded. And this is a plus for health and budget, but for pharmacists minus. From this you can draw another conclusion - to earn and save money easier for a healthy person. And this means that it is necessary to change not only thinking, but also the way of life.

Learn how to delay

Learn how to delay So, we examined what aspects of life prevent us from becoming richer. We pass directly to how to effectively accumulate money and not squandered on the first impulse.

The most effective ways to save money

The most effective way to save money is to put money so that it is impossible to use them at will. It may be a relative to whom you deposited money for storage on condition that he will give you only in case of real necessity.

With such a role, parents are best able to cope. But most often for such purposes use reliable banks. Before opening a deposit, be sure that it is insured, and the amount of compensation exceeds the amount you must receive at the end of the deposit period.

Create the desire of

Create the desire of 10%.This is the amount with which you can part without a thorough budget cut. Establish a rule of a certain percentage, and you will never get into debt. In any case, you will have deferred money "for a rainy day."

Only 10%

Only 10% We give the percentage distribution of money, which slowly but surely will allow you to save money. Not necessarily the percentage should be exactly this, change at your own discretion either or different points:

- 10% the amount is postponed "for a rainy day", which can include an unexpected illness, loss of work, death or invalidity of the breadwinner. If the amount does not come in handy, you will have decent capital for retirement, for example, for a round-the-world trip. Yes, it is these 10% that give the Europeans a possibility of a saturated pension, than we are worse

- 5-10% depending on the possibilities for vacation. Thus, the cruise does not earn, but the lion's share of vacation spending can be cut off

- 10% for unforeseen current expenses. They include current treatment of family members, repair of household appliances, purchase of a new one if necessary. Some mistresses, who did not squander this part of the money, managed to make repairs at the end of the year. Is this not an incentive

- 10-30% is postponed to the desired large purchase. It can be a car, a cottage, and even a new house

Collecting money for a dream

Collecting money for a dream When you first read about this scheme, you are most likely in indignation. That's up to 50% of my income? My salary is enough until the next salary. No, it's not for me. Maybe today and not for you.

The first step is to start budgeting, the second step is to see how you can increase your budget( about this a little later), the third step is how you can cut costs. And then you will see how you will have "backup" money, which you can save.

To save hard, but efficiently

To save hard, but efficiently How to save money for a teenager, a student? How to save money for a student?

For those who have passed the way of tranportation, and on a certain path of life realized that they lived in a consumer way, without postponing anything and not having acquired anything, it is very important that children do not face the same difficulties. Do you want your child to learn how to save money, postpone and do not climb into loans in the future? First you have to show your own example.

How to save money for a teenager, schoolchild

How to save money for a teenager, schoolchild The needs of schoolchildren are much higher today than before. Today gadgets are not only an interesting toy, but a necessary thing. But do not immediately acquire the desired thing. Try to save up with the child.

Give him an amount slightly larger than he needs for lunch and put a piggy bank at home. Offer the saved money to save on the cherished thing, in order to get it faster. Thus, you will learn not to spend all that is in your wallet, but to plan your spending, postpone and save.

Interactive work is now available for teens as well

Interactive work is now available for teens as well High school students may want to increase their income through part-time work. Many parents are opponents of work in adolescence, but in vain. If part-time does not interfere with the educational process, and also does not damage the health, do not dissuade. On the contrary, think about how you can help.

Perhaps you will be able to help get a job done on intellectual work( telephone sales, freelance, office assistant, etc.), as well as courier work, distribution of leaflets, presentations in supermarkets.

Encourage the child to try to save money

Encourage the child to try to save money Of course, at this age you want to spend a lot. Set a goal, hang a photo in front of the table with a welcome purchase, on which you collect money. And have patience!

How to save money without work?

It's good to have a job where a decent salary is paid. But here's what to do for those who do not have a job now. This is the students, and mummies in the decree, and temporarily unemployed. Can they save money? Completely. After all, the availability of work and the availability of earnings, absolutely different things. The most incredible lessons today can be turned into income.

How to save money without work?

How to save money without work? Hobbies. They each have their own. If you are fond of Handmade? Turn it into your mini-business. You can make to order, sell finished products, as well as conduct master classes and lessons.

Subworking in the decker

Subworking in the decker Are you keen on sports? Do you know effective methods of training? Try to organize training in the fresh air for a nominal fee. For you it is experience and a small income, which in time can turn into a profitable occupation.

Can I earn on the Internet

Can I earn on the Internet Do you know foreign languages? The work of translators is more and more in demand. Wrote the compositions and you have a beautiful syllable? Try on the freelance exchanges, if your writing talent is in demand, it will give a good income, from which you can save a very decent amount.

Earning on the Internet is easy!

Earning on the Internet is easy! All these types of earnings involve profit in small amounts, but often. Thus the person thinks, here I shall spend today, and already tomorrow I will postpone. At the end of the month, at the same time, it is more difficult to postpone a large amount, since the amounts are still small.

Make a rule to postpone each receipt, regardless of its amount. If there are several earnings per day, allocate a few minutes in the evening to calculate the total profit and postpone a fixed percentage.

Money flow

Money flow How to save money for a car? How to save money for a house?

It's good to delay 10-30% of course, but you want to buy a car after all, not in 30 years, but in a year, well, a maximum of two. And the apartment is needed, as they say, yesterday. Here, a slow but sure technique does not work out a bit.

To delay by 10-30%

To delay by 10-30% First, it is necessary to collect not for ghostly dreams, but for real facts. When choosing a car, decide whether you need a new or used. Brand, year of manufacture, and other details. Decide on the price in the purchase currency( dollars).Then, the real term for which you want to accumulate.

Accumulate the machine

Accumulate the machine So, the amount of the machine / for the number of months( - leave).The amount that must be deferred.

Now the amount of compulsory expenses( and here already helps to manage the budget): food, utilities, travel expenses, school, garden, replenishment of phones, current spending on clothing. If the total is 100% or even less, your income is excellent. The calculation is ideal, we begin to postpone.

If the amount is more than 100% there are two options - to find a part-time, additional income, or to delay the purchase of a car for a certain period, splitting the sum for more months.

Video: How to save money - save up for an apartment, a car?

With the purchase of an apartment, the issue is slightly different. We do not recommend collecting the entire amount, but only the amount of the initial mortgage payment. The scheme is the same as with the machine. And now more in detail, why it is necessary to collect only for the initial payment.

Accumulate the apartment really

Accumulate the apartment really - You rent housing. Monthly you give the tenant a certain amount for rent. Also, you yourself will pay the same amount( and possibly less) for a mortgage, but you will pay for your housing, not someone else's

- . You have housing, but you want to improve your living conditions, or buy an apartment for the growing children. Collecting the initial payment and taking a mortgage, you can not settle in the apartment, and hand it over

- Part of the amount will go to pay utility bills and current repairs( if necessary), and part of the amount will serve to pay off the mortgage. If you, as before, continue to postpone the same amount, you will pay off the loan twice as fast

Video: How to save and save money in terms of psychotechnology?

In both cases, the benefit is obvious. It remains only to save up for the down payment, but this is only 1/4 of the apartment value.

How to save money for repairs?

Repair can begin, but it's impossible to finish, say many. It's not true, it all depends on how you do it. In order to repair did not turn into a way of life it is better to do it gradually, but still in one fell swoop.

How to save money for repairs?

How to save money for repairs? Again, planning comes to the rescue. What will you do, what kind of work can you do yourself, and for which you will need to hire workers. Cost of works, terms. Prepare an estimate and print the final amount. Depending on the possibilities, break up the amount for 6-12 months, but that the amount that had to be postponed was real and feasible.

Video: How to save money?7 simple rules

As practice shows, if you put the main purpose of repair in the house, then in just one year you can save up for excellent repair.

How to save money in a bank?

Today, banks offer excellent opportunities for opening deposits with the possibility of additional investments. Doubt in the banking system? Afraid of bankruptcy of the bank? Be sure to check that the deposit is insured.

Also in the world practice recommend not to lay all your savings in one bank, and distribute in several, but reliable. Another nuance - bankrupt themselves declare most often small banks. With major problems happen much less often.

How to save money in a bank?

How to save money in a bank? How not to spend the accumulated money?

At first it will be difficult. After all, you are used to spending, and the thought that somewhere the amount of "no-deal" lies will bother you. In the first year of savings, open a deposit that can not be terminated early. Usually a year is enough to get used to saving and not wasting.

How not to spend the accumulated money?

How not to spend the accumulated money? Another way to restrain yourself and not spend money is visualization. Posters, photos, screensavers with what you save. One look at the dream and the desire for an "impulse" purchase will disappear by itself.

How to save money: tips and feedback

Inna: my first job was with my dad in the office at the age of 14.Having received "impressive" first money I wanted to run to the shops with my girlfriend. But Dad said to achieve a lot, you need to postpone the opportunities. And we went to the bank. Dad opened a deposit on me, and I put the crumb - the cherished 10%.Not at all upset, because I had 90% of the money I ran to my friends. Since then, 10% of each profit has gone to the bank account.

I did not have a permanent job, but there were work-outs, later freelancing and writing coursework. After graduating from college, my young man and I decided to start a family. His parents were against it, since we have nothing. Imagine their surprise when they found out what I had accumulated during the study period for 3/4 of the apartments. Thanks to my parents, today I live in my own apartment, I raise a son, and my husband and I are doing excellent farming!

Karina: the economy always seemed to be something for the poor. Parents shielded me from the vicissitudes of life, and even in marriage, I did not need anything - parents always helped financially. But then everything went down. My parents are retired, I have no more money to help me, my husband lost his job, and I am in a decree. And then I came across an article and a home budget and how to save. The first was denial. I could not postpone anything before, how to do it now?

But with the spouse we downloaded the program and began to write down all our expenses for the last year( the benefit of the account statement is always available).My husband had a shock, we spent a large half of the income( even without knowing it) for public catering, entertainment and clothing. After reviewing the way of life, we were able not only to live, but also to postpone his unemployment benefits! Well, then he found a job, I found a part-time job, and life began to spin again. Only now we will save our son on the house, after all very soon he will grow up, and we should help him.