Questions on real estate transactions are difficult. This reminder for selling an apartment will tell you how to solve the problem.

Contents

- Can I sell a non-privatized apartment?

- 1. To register a buyer in the apartment

- 2. Privatization of the apartment together with the buyer

- 3. Using the "buffer" apartment

- Is it possible to sell a share in a privatized apartment or half of an apartment: one-room, multi-room?

- Is it possible to sell an apartment with a registered person and without his consent?

- Can I sell an apartment or a share of an apartment if a minor child is registered there?

- When, through how much can you sell an apartment inherited after donating, privatizing, buying?

- Can a guardian sell an apartment incapacitated?

- Can I sell an apartment with illegal re-planning?

- Can I sell an apartment with debts on utility bills or other encumbrances?

- Can I sell an apartment if you get a subsidy?

- Is it possible to sell the apartment by proxy from the owner?

- Can they sell an apartment without the owner's consent?

- Can I sell an apartment with parent capital?

- Can a husband sell an apartment to his wife, a grandmother to a minor grandson, a daughter's mother, a son?

- What is better to give or sell an apartment to a relative?

- Can I sell an apartment on a mortgage of Sberbank or another bank: pros and cons?

- Can I sell an apartment on a military mortgage?

- I sold the apartment, do I need to file a declaration? When does the tax on the sold apartment come and what?

- Is it easy to sell an apartment to a studio?

- Can I sell a room in a communal apartment?

- Can I sell an apartment to a state bank?

- Is it possible to return the sold apartment back?

- Video. Buying a property for sale

People who do not often face real estate transactions find it difficult to navigate among the mass of information available. The article gives answers to many complex apartment problems.

Can I sell a non-privatized apartment?

This apartment is the property of the state, therefore, tenants can not sell it. But there are several schemes that allow to solve this problem.

1. Register a buyer in the apartment

- The easiest way to sell: you get money from the buyer, register it in the apartment, and write yourself out. After this, the buyer independently engages in privatization.

- The propiska of a person before privatization is possible after obtaining the consent of the owner - the municipality, state.bodies. If the state bodies refuse to register, then it is almost impossible to challenge this decision.

2. Privatization of the apartment together with the buyer

- The buyer participates in privatization, pays a deposit for privatization. The apartment is sold to the buyer under the standard scheme after the seller receives the rights to sell it.

- It is recommended to conclude an agreement with the buyer, where all the points of the transaction will be registered, up to the obligation to formalize the sale of the object after its privatization.

Complexities of selling a non-privatized apartment

Complexities of selling a non-privatized apartment 3. Using a "buffer" apartment

- A "buffer" apartment is an agency-owned living space that is used for real estate exchange. Here you need full confidence in the real estate agency, otherwise - it's better not to take risks.

- The buyer gives money to which the buyer buys an apartment-buffer from the agency. Then the privatized apartment-"buffer" is exchanged for a non-privatized living space. The seller leaves the apartment, the buyer prescribes. In the end, the buyer returns the "buffer" to the agency and receives the money.

But before you begin the sale process, make sure that the apartment is subject to privatization. For example, social housing, apartments in special houses, military towns can not be transferred to the ownership of ordinary citizens. If privatization is possible, then act.

Allocation of a share of an apartment

Allocation of a share of an apartment Is it possible to sell a share in a privatized apartment or half of an apartment: one-room, multi-room?

- If the property is a common joint property - any operations with the property are possible only with the consent of all participants. Otherwise, it is impossible to give your share even to a relative. The issue can be resolved through the allocation of its share, by applying to the court, the notary.

- After allotment of a share, the owner begins to own his part of the property. The right to share ownership gives you the opportunity to sell your share. The rest of the owners have priority, in order to redeem the selling stake. They must be notified in writing.

- Proof of notification can be a certificate certified by a notary. Without evidence of official notification, the sale of a share may be canceled.

- A month later, if the tenants did not use their right to purchase a share of the property, the owner can sell it.

Residents when selling

Residents when selling Is it possible to sell an apartment with a registered person and without his consent?

You can sell an apartment. Article 304 of the Civil Code gives the owner the full right to dispose of the apartment without the consent of the registered ones. But the law protects the right of registered individuals to live in the place of residence.

Although selling an apartment is the basis for stopping its use by all registered residents, but it will be difficult to write them out without voluntary consent. First of all, those who can not be evicted: disabled citizens who refused to privatize, have the right to live for life, minor children. The rest of citizens can be written through the court.

Is it possible to sell an apartment or a share of an apartment if a minor child is registered there?

The law does not prohibit the sale of an apartment with an assigned minor. Those.the process of sale and processing of documents can begin before the child's discharge. But you need to get permission to sell from the guardianship authorities.

For this it is necessary to provide documents that all the housing rights of the child are observed and it is not infringed.

At the time of the transaction, the child must be discharged.

Sale of real estate - a delicate matter

Sale of real estate - a delicate matter When, through how much you can sell an apartment, inherited, after donating, privatizing, buying?

An inherited apartment, donated or privatized, can be sold after registration of property rights. Darynaya is issued for several months, the inheritance is six months. The process of privatization lasts an average of 3-4 months( although by law - 2 months), and if there are legal proceedings, then in 9 months you can not keep up.

But if after obtaining real estate ownership it took less than 3 years, when selling, personal income tax is paid, 13%.If more than 3 years - do not have to pay.

Can a guardian sell an apartment incapacitated?

The guardian can sell the property of the incapacitated, but two conditions must be met:

- permission of the guardianship authorities

- the sale is carried out solely for the benefit of the person under care: change of residence, payment of expensive care for the sponsored

Sell property only to unauthorized persons. Neither for himself, nor for his relatives, the guardian can not sell real estate.

Red lines that reduce the value of real estate

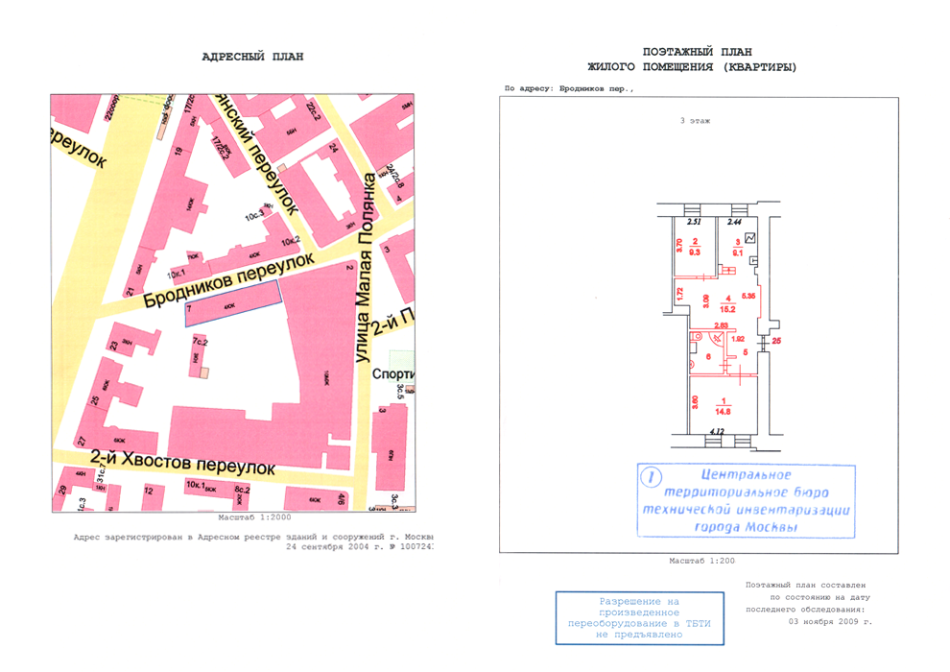

Red lines that reduce the value of real estate Can I sell an apartment with illegal re-planning?

Legally, you can not sell such an apartment, because before selling you need to call a BTI technician who will inspect the apartment and check it for compliance with the original plan. If there are any uncoordinated changes, the technician will mark them red on the apartment plan. A transaction with such marks on the plan can not be registered.

Illegal redevelopment threatens new owners with great material costs: when the "reappear" of the fact of redevelopment, the owner will either have to legalize the changes, or return the room to its original appearance.

To reconcile the redevelopment, it will take up to 2 months if the bearing structures were not affected and up to 6 months if there were global changes and capital structures were affected.

Encumbrance of an apartment

Encumbrance of an apartment Can I sell an apartment with debts on utility bills or other encumbrance?

The presence of debt does not affect the ability to dispose of property.

- The debt is held by the seller until it is fully repaid if the buyer does not agree to transfer the debt into his name. If the debt was not transferred, the municipal services should not require its repayment from the new owner, but they can send letters to the address with the requirements of debt repayment.

- An apartment with encumbrance can not be sold if it is under arrest.

- If the apartment is a lien, and the owner has debts in the bank, then the property can be sold only with the consent of the bank.

- When repaying a mortgage through a parent's capital, in addition to the consent of the bank, the consent of the guardianship authorities still needs to be agreed. Otherwise, the child after coming of his age can seize the apartment back.

Can I sell an apartment if you get a subsidy?

The purpose of the subsidy does not affect the procedure for the sale of housing. It is not necessary to return money, because this kind of targeted assistance is only returned in cases of incorrect reflection in the income statement of the tenants. The only thing that needs to be done is to inform the social authorities.protection of the sale of housing for a month.

Power of Attorney is legal

Power of Attorney is legal Is it possible to sell the apartment by proxy from the owner?

Sale of property by proxy is a completely legal and permissible transaction. The danger for the buyer can arise if the trustee starts acting not in the interests of the apartment owner - sells for nothing, does not give the owner all the agreed amount, other fraud.

Therefore, the buyer is advised to comply with certain rules:

- Make sure that the owner is alive, capable and issued a power of attorney at will.

- Make sure that the owner is willing to sell the property at the agreed amount. It is desirable that the minimum cost of real estate was prescribed in the power of attorney. Or, try to obtain other evidence of the owner's consent with the amount of the sale of the apartment.

- Indicate the full cost of the apartment in the contract. Do not underestimate the real value or make out a gift agreement to avoid tax. If suddenly the owner will resist selling, the buyer will be refunded the amount under the contract.

Black realtors

Black realtors Can they sell an apartment without the owner's consent?

You can not do this legally. But "black realtors" are able to conduct such an operation.

- In this case, the originals of documents for real estate fall into the hands of scammers who draw up a power of attorney, then - a contract of sale and sell an apartment using communications in various services.

- Documents can be seized under the plausible pretext of speeding up the transaction, transferred by "kind" relatives, are stolen.

Can I sell an apartment with parent capital?

Legislative there is no ban on the sale of this housing.

- But when selling, the rights of the child must be respected. Children are also owners of the apartment and, upon their sale, their consent is taken into account. If children are under 18 years of age, the consent of the guardianship authorities is necessary for the sale.

- For the approval, proofs are required that children will be provided with housing, and their living conditions will not deteriorate.

Sale of real estate to close relatives

Sale of real estate to close relatives Can a husband sell an apartment to his wife, a grandmother to a minor grandson, mother of her daughter, her son?

- A husband can sell a property to his wife, since he has the right to dispose of his property.

- If the apartment was purchased in a marriage and the property is jointly acquired, the wife's consent is necessary for the purchase / sale transaction.

- It turns out, that the contract is made out as though with itself. Such a transaction between spouses is fairly easy to challenge. If the property is acquired outside of marriage, such problems do not arise.

- Sale / purchase transactions between close relatives are permitted. Exception - if the buyer is underage. You can give him an apartment only by donating, donating. Therefore, neither grandmother, nor mother, nor anyone else can sell the apartment to underage children.

Sell or present?

Sell or present? What is better to give or sell an apartment to a relative?

With close( first degree) kinship, participants do not pay taxes when donating transactions.

- If the property is given to a close relative, the gift contract is more favorable to the donor, since when selling it, he will have to pay 13% of personal income tax. But only if the donor owns the property for up to 3 years.

- If you are a relative of the second and further degree, then the gift tax - the same 13%, will have to be paid. It is also necessary to evaluate the apartment, and it is necessary to take into account the additional costs for the notary.

- The seller of property can bear expenses: taxes, services of the expert-appraiser, the notary, registration of the contract, payment of the state duty, and the buyer pays only for registration of the property right.

Conclusion: the gift contract is beneficial only between first-degree relatives. For the rest:

- when selling significant expenses is borne by the seller

- at the donation - gifted.

Credit apartment

Credit apartment Can I sell an apartment on a mortgage of Sberbank or another bank: pros and cons?

Sell - you can, although more difficult. Banks in most cases agree to the resale procedure, especially if the borrower's financial situation worsened. But the reasons for the deal must be weighty.

Pros:

- seller is relieved of debt because she will sell the apartment and

- debt the buyer can purchase a house for less than the average cost in the market

Cons:

- find the buyer will be more difficult, since not everyone wants to contact the mortgage housing

- you need to get the bank's permission forsale. To do this, it is necessary to prove the solvency and reliability of the buyer

- bank establishes the procedure for transferring money to the buyer

- the bank can change the lending terms for the buyer of mortgage real estate, as it will conclude a new loan agreement with the new borrower. Conditions may differ and not be profitable.

Military Mortgage - all strictly

Military Mortgage - all strictly Can I sell an apartment on a military mortgage?

With a military mortgage, collateralized property, i.е.the apartment is owned by the state. Therefore, you can dispose of it only after the loan is repaid, and also the removal of the encumbrance, and nothing else. The main issue is the issue of obtaining money to repay the loan.

Variants of sources for loan repayment:

- personal savings.

- is a short-term bank loan, which is very rare, since the amounts for ordinary consumer loans are high.

- receiving the buyer's money to repay the loan. At the same time, an agreement is drawn up where the buyer agrees to prematurely deposit money into the apartment account in order to remove the encumbrance from the purchased apartment. The cost of an apartment is usually reduced, since the buyer is at great risk.

Taxes

Taxes Sold apartment, whether it is necessary to file a declaration? When does the tax on the sold apartment come and what?

The tax is paid when the sale of real estate received income if the real estate owned up to 3 years( from 2016 - up to 5 years).

It should be remembered:

- The tax for residents is 13%, and for non-residents - 30% of income.

- When selling, it is necessary to file a 3-NDFL declaration before April 30 in the next year after the transaction is registered.

- You can reduce the tax by the amount of the tax deduction in the amount of 1 million rubles or for the amount of confirmed costs that were incurred on the acquisition of this apartment.

If the property:

- is presented by a close relative;

- inherited;

- was privatized;

- is re-registered under a rent contract,

then sell it and do not pay personal income tax can be in 3 years from the beginning of ownership, and not 5, even if the event occurred after 2016.

Studio apartment - it is compact

Studio apartment - it is compact Is it easy to sell an apartment to a studio?

Such a housing has its own specifics, so there can be difficulties with the sale.

Advantages of the studio:

- space optimization, all the necessary things "at hand"

- relatively low cost of housing

Now studio apartments have started to be in demand, as young people increasingly want a separate housing as soon as possible. For them, leading a dynamic lifestyle, little time at home and little preparing such affordable housing, is the best option.

Often, such apartments are bought for elderly single people.

Utility room

Utility room Can I sell a room in a communal apartment?

- Only the room that is located in a privatized apartment. Otherwise, the room, like the apartment itself, belongs to the municipality, sales operations are prohibited.

- Residents of the communal apartment are the first in the right to purchase such a room. Therefore, in the process of obtaining the consent of all neighbors for the sale of a room, it is worthwhile to be scrupulous, so that the transaction is not subsequently canceled. Even if the neighbors are against and do not give consent, it is enough to notify the notary about the sale. In a month, if neighbors do not agree to buy a room at a specified cost, then you can sell to anyone.

- If there are several owners of the room - issue a permission to sell the common property.

- Write out all the tenants of the room.

Can I sell an apartment to a state bank?

If an apartment can not be sold, then it can be offered for purchase, for example, to the state. The municipality holds contests for the purchase of housing for orphans, information can be found on city sites and offer their apartment. But usually it's cheap and long.

Banks can buy an apartment only for their own needs. Usually they only realize the collateral property, the loan under which the borrower can no longer pay.

Return the apartment! Fraud!

Return the apartment! Fraud! Is it possible to return the sold apartment back?

The apartment can be returned if:

- , the buyer / seller substantially infringed the rights of the other party to the transaction, failed to fulfill the obligations, and the second party, as a result, suffered significant losses.

Ie, if there were fraudulent frauds:

- the buyer did not pay a certain amount for the property

- the seller deceived, saying that the claimants for the property are no longer

- the transaction is concluded with the person who is incapacitated

- the transaction was fraudulent, which confirms the criminal case.