Want to learn how to properly manage the family budget? Read our article.

Contents

- Family budget role

- Family budget types

- Joint and separate family budget

- Advantages of joint budget

- Disadvantages

- Separate budget

- Share or mixed budget

- Rational family budget. How to save a family budget?

- Expenditure items of the family budget

- How to properly manage the family budget?

- Allocate money for rest, entertainment. Nothing so does not unite the family, as a carefree time spent together. How to plan the family budget in a crisis?

- Video: How to save money?

- How to plan the family budget in advance: advice and feedback

- Video: Planning of the family budget

For the well-being of the family in financial terms, it is necessary to choose the most appropriate budget planning model from the very beginning. Without this, there can be no question of success or financial independence. Even big earnings with illiterate planning and wrong spending of money, are not a guarantee that the income will suffice for all needs. Therefore, it is important to build a family budget in such a way that money is spent rationally.

The role of the family budget

The role of the family budget is:

- in controlling the financial state of the

- family achieving certain goals that require cash investments

- eliminating unnecessary expenditure

- cost planning

- maintaining the financial discipline

- improving the welfare of the family

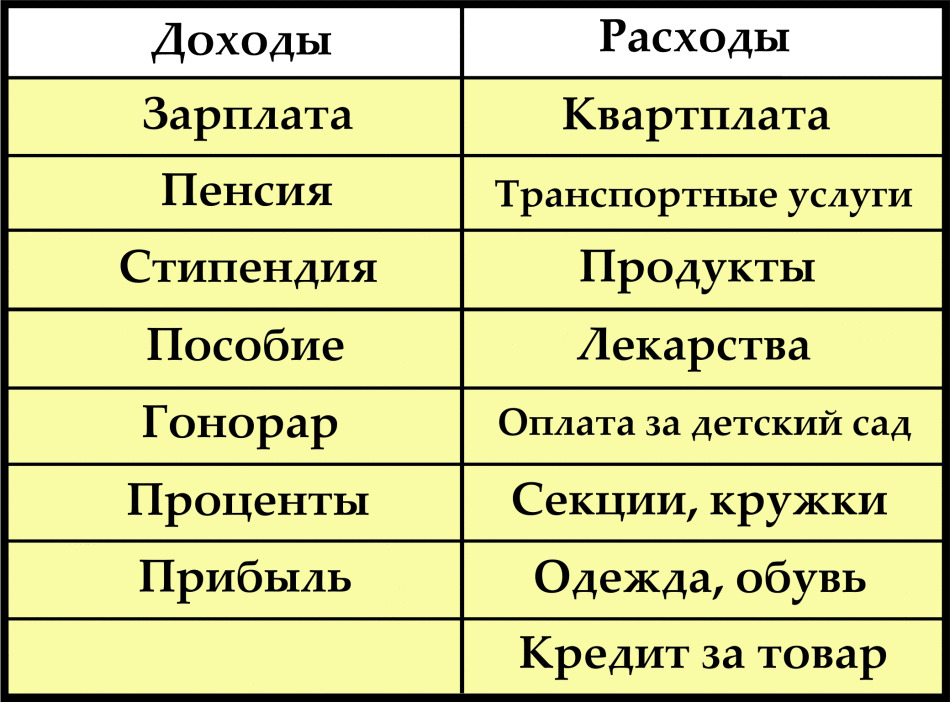

The components of the family budget are incomefamily members.

In a classical family consisting of 3 people( two parents, a child), it is formed from the income of 2 working people, and is divided into 4 main areas:

- to provide the family

- for the husband's personal expenses

- the costs of the wife

- the contents of the children

Deviations are also possible:Only 1 person works, there are no children in the family. Then 1 of the items is eliminated, but 3 remain stable.

Types of the family budget

The family budget can be divided into 3 types:

- joint

- separate or independent

- mixed, shared or joint

Joint and separate family budget

We traditionally use the first category of the family budget. Working family members combine their income and from this total they take money for all arising costs. Recently, the trend has changed somewhat. Increasingly, there are families that use an independent or solidary type of budgets.

Earn money and dispose of them are not always the same person. On this basis, the joint budget is divided into 4 subspecies:

- In the family, two earn and share the expenses

- Earn only 1 of the family members, but allocate the budget to two

- The budget consists of two people's incomes, but disposes of one

- One person brings money to the familyand 1 distributes them, and the manager is not necessarily the one who earns

Advantages of the joint budget

Such management has its advantages:

- There are no secrets about the financial statefamilies. Everyone knows how much you can spend before the next

- funds come. Convenient to save up for large purchases or create stock

closer, more trusting relationships are formed. Disadvantages of

In the families that chose the joint method of budget management, the problems arising on this background are not an exception:

- If the earnings are very different, there may be discontent about the distribution of expenses

- When two people manage the finances, it is sometimes difficult to make a common decision

- There is no way to accumulate an impressive amount on your own to spend it on a gift to the spouse

. In addition to the above, there is the possibility that the one whoearns less, will not seek to increase his personal income if his needs are fully satisfied from the general cash desk.

Separate budget

- In this case, the budget is administered by everyone at their own discretion, while they do not depend financially on each other. This model is typical for Western countries. The decision to pay for both family and personal expenses is made by each independently on the circumstances. About large expenses, they can agree

- The advantage of such a budget is that there is no reason for quarrels concerning financial matters. In addition, based on their income, each spends as much as needed

- The income level, while it should be significant, but even in this case, if you spend money unreasonably, then it is unlikely to make big purchases. Again, the cost of children to maintain the house. Here, too, fertile ground for disagreement

- There is absolutely no reason for disputes around the financial issue, if the incomes of both are stable and not particularly limited in size. With an unsystematic approach, costs only increase

Share or mixed budget

This type of budget is a combination of the first two. At the same time, spouses allocate part of the money for household expenses, and the remaining spend on their own needs. The share of each, as a rule, is stipulated in advance.

This type is an intermediate link between joint and separate budgets. People who have parents on their care, children from the previous family, relatives, the mixed budget is more suited than others.

Rational family budget. How to save a family budget?

Rationally called the budget, in which the expenditure part does not exceed the revenue side. This balance is achieved only through planning. There are certain planning rules, from which it is possible to single out 3 main ones:

- It is very clear how much money goes into the family. To do this simply, it's enough to take a notebook and pen and perform simple calculations of the net profit of each member of the

- family. How can you more accurately determine the monthly expenses. Usually they are divided into mandatory and optional. The first group includes payments for utilities, repayment of loans. In the second: buying clothes and other goods, paying for repairs and refueling cars, purchasing products

- To properly dispose of the remaining finances - to acquire something that allows you to receive additional funds in the future or put in the bank

If the balance between income and expense turns out to be negative,will have to give up something. Mandatory payments for this and mandatory, that they can not be delayed in any case, otherwise there will be negative consequences.

If the balance between income and expense turns out to be negative,will have to give up something. Mandatory payments for this and mandatory, that they can not be delayed in any case, otherwise there will be negative consequences.

Expenditure items of the family budget

- To revise will be an optional part of the costs. Start with the major purchases planned for the current month. Think whether it is possible to postpone their

- To begin with, a list of all necessary costs should be compiled, determining the order of the location of each action or thing in terms of importance. At the very end are the names of things that are not required to purchase

- If there is a choice between buying an electric oven at a cost equivalent to the amount allocated for a weekly meal, then the second is definitely more important. On the oven can be collected gradually, adding up the amounts left at the end of the month. Otherwise, having immediately spent all the income on the oven, you will find that you simply have nothing to put in it, because the money products just did not remain

- You can save on unforeseen expenses if you do not buy new things thoughtlessly. When a washing machine or a vacuum cleaner breaks down, try to turn them in for repairs - this is the most rational option

- Calculate how much you need to leave to buy products, especially expensive ones. It is checked that it is better to make purchases for a period of a week or more, instead of replenishing every day. Ideally, in general, do not go to the supermarket until it ends what was intended to be used in a week or two.

- Costs for clothes, although they are of secondary importance, but they can not be avoided - children grow, we gain or lose weight,then goes out of fashion

How to properly manage the family budget?

- buy items only necessary wardrobe

- visit sales

- use coupons and discounts

- be interested in prices because in shopping outlets with discounts they can be higher than in other stores

Allocate money for rest, entertainment. Nothing so does not unite the family, as a carefree time spent together.

How to plan the family budget in a crisis?

How to plan the family budget in a crisis?

Delay at least a little bit, but regularly for every unforeseen event. At all times, and especially in a crisis, you can not be completely confident in the future, but in your power to make it a little easier if there are any reserves.

Video: How to save money?

How to plan the family budget in advance: advice and feedback

The generator of ideas for improving everyday life and welfare in most families is a woman. Sometimes they are very addicted to saving, they deny themselves in many ways, and until the next salary they still do not have money. Therefore, it is worthwhile to listen to advice on how to rationally shop at a supermarket and save money in other situations:

- Make a list in advance and take from the shelves only what it says. Just impulsive purchases are unnecessary

- Buy more often in online stores, many things are cheaper there.

- Do not take with you a large amount of

- Try to buy products that are stored for a long time, as well as household chemicals not in retail, but in bulk - large packages. Immediately it will cost a large amount, but in the end it will be cheaper than

- . Do not waste money yourself and accustom the rest of the family to it. Even daily purchases of such trifles as magazines, juices, chips, seeds, are ruinous for the family budget

- Be sure to recalculate the change and the total amount in the wallet. Without an accurate knowledge of the amount of funds available, it will not be possible to spend them deliberately

- If you or other family members visit clubs, gyms, mugs, it is more profitable to buy a subscription for a year. In this case, the cost of an individual lesson will be reduced 4-5 times. Register in a group, it's much more economical than individual classes

- Replace all bulbs with energy-saving ones. They are more expensive, but last longer, and the energy consumption is reduced to 5 times.

- When buying a refrigerator, choose Class A. Set it away from heating appliances to consume less power.

- If there is an electric stove in the kitchen, keep the burners clean and in good condition, otherwiseelectricity will increase by a factor of 2. Do not overheat by turning off the cooker periodically for 12 minutes.

- Proper use of household appliances also affects the saving of money. Even if you take the rule when using an iron at first to iron things that require a small temperature, and then increase the temperature and iron the rest, then the economy will be noticeable.

- Set the meters to water and gas. Keep in mind that nowhere dripped

Take it responsibly to planning the family budget. Act consistently in one direction, and you will avoid most problems, both financial and in terms of building a strong family, where relationships are built on trust.