Have you decided to close the individual entrepreneur?

And no matter why - did not go to trade guinea pigs or you married an English lord and move to live in his ancestral estate - the fact remains.

But there is a "tiny" problem: you, as an individual entrepreneur, owe money to someone.

You should not do plastic surgery and go on permanent residence in Cuba!

We will teach you, how to properly close the IP with debts.

Who needs to know how to close an IP with debts?

-

to those who are in a happy ignorance that irrespective of whether his business earns income, the debt to the Pension Fund is inexorably growing.

And do not play in this institution the scene "We are not local people!" And refer to hard times - it will not help!

-

to those who really "finance sing romances" and they did not pay all the taxes and payments due to social funds.

Time-wasting, unfortunately, does not make you rich uncle Scrooge!

-

to those who are firmly convinced that the question "How to close the IP with debts?" Is a problem of almost universal scale, and therefore it is better to let things go by themselves.

Stop it!

Nothing is impossible for a person with brains and good motivation.

2 possible ways to close an IS with debts

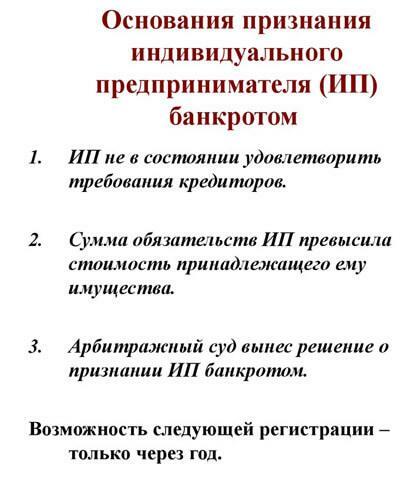

Method No. 1. How to close an IP with debts, if you are a bankrupt?

That's really really complicated and expensive procedure for declaring yourself bankrupt is beneficial to start if the total amount of your debts exceeds 300 thousand rubles.

And without consulting a wise man like the Athonite elder, a lawyer can not do without you.

Therefore, in the vast majority of cases, IPs are closed through a de-registration from the tax inspection( regorgan).

Method No. 2. How to close the IP with debts in the regurgan: step by step

The decision to close the FE in the tax inspection can be broken down into the following stages:

-

Find out if you have submitted all the necessary reports to the Pension Fund.

If it is not so, convey the necessary papers.

Without this, you will not move further;

-

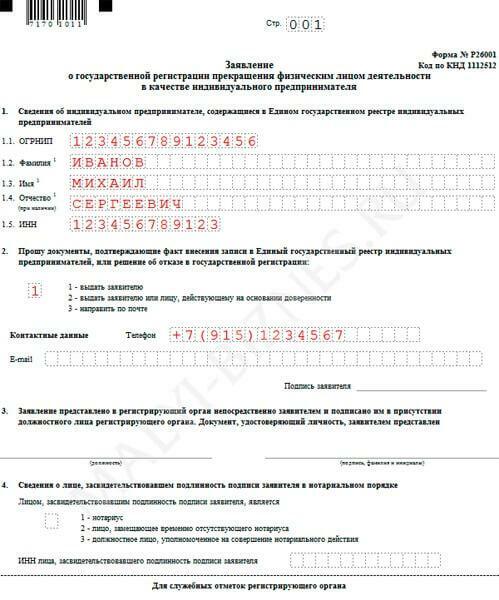

To write the corresponding statement that you, as IP, close.

-

Raskoshelitsya to pay state fee.

You can receive all necessary details directly in the regurgan.

Be careful when paying to transfer money to the account in question.

-

Receipt for payment and your application to be included in the contract.

Complete the application twice.

On the second copy, ask the secretary to put the registration number and signature.

As they say, God cares!

Including from careless officials;

-

After 7 days, pick up in the regurgan a document confirming that you are no longer an individual entrepreneur.

Dance and have fun, because now you can forget about visits to the tax, as a terrible dream!

All this rigmarole will take no more than 14-15 days from you. For a moderate fee, private lawyers can do this procedure.

Then you need to issue an order from a notary.

Adds optimism and the fact that as soon as the information on the liquidation of the IP falls into the Unified State.register, the bank itself will close your settlement account, and the tax inspection from the account will remove the cash register.

On the closure of an IP with debts: creditors are different, creditors are needed. ..

1. We learn to close the IP with debts to employees and partners.

Even if you owe money to your counterparties or hired employees, this will not prevent you from closing the IP.

Regorn will not demand here and now pay off with suppliers or a respected Raisa Petrovna, even if she has worked for you as chief accountant for 15 years.

By and large, you are not even required, unlike a legal entity, to report liquidation and tell everyone that the entrepreneur has failed.

But do not rush to dance with joy in a twist in an empty office!

The fact is that debts are "hung" on you, as an ordinary individual, such Ivanov Ivan Ivanovich himself.

And the same Raisa Petrovna can safely go to court, waving a labor contract or work book in order to demand payment.

And it will be absolutely right!

And about the decency and business reputation should not be forgotten.

Perhaps in a couple of years you will again want to try your hand at the "wild" Russian business.

2. How can the IP be closed for various fees and taxes?

If you are wise on how to close a PI with debts to the budget of your home country, we advise you to remember that:

-

an entrepreneur can close and before paying off all his debts.

Until 2011, the IP during liquidation was required to file a certificate of absence of debts for various state fees.

But since 2011 the situation has changed: the regurgan will receive this information not from you, but from primary sources( for example, from the Pension Fund), within the framework of the interagency agreement;

-

after closing all the debt of the entrepreneur are considered yours, as an ordinary physical person.

After the information that the IP is closed will be entered in the EGRIP( Uniform State Register of IP), you will have exactly 15 days to give all the money debts to the state( all kinds of taxes, insurance fees, etc.).).

If you could not pay, all interested organizations can safely go to court "for your soul."

After the judge has made a decision to enforce the debt, wait for the bailiffs to visit.

-

all your personal property can be used to cover debts.

They can not only encroach on housing( if you have one and only one), food( what should tax collectors do with buckwheat or a bag of cabbage?), Personal belongings( except for luxury goods).

Have you already thought about where to hide family jewelry and silverware before the bailiffs come?

How to find your business: recommendations from businessmen

The only situation when thinking about how to close the IP with debts is useless!

On the way to your goal - the closure of an individual entrepreneur - can only stand up vigilant employees of the Pension Fund. Upon the request of the regency, they send him their report on the IP.

If it means that you owe any papers, then you can not see the closure as your own ears.

That's why it's necessary to decide how to close the IP with debts, from the "reverence" to the Pension Fund in the form of handing over all the reports, but do not forget:

-

is originally about reports, and not about payment of debts on insurance fees.

The reference from the FIU only confirms that you provided him with all the necessary information for calculating the pensionable period for you and the hired employees, if any;

-

, the existing debts to the Pension Fund can not serve as a reason for the tax authorities to refuse to take you off the register as an individual entrepreneur;

-

you owe PF money sooner or later you will have to pay.

After all, all the debts of IP become yours, as an individual.

If there is no payment, the organization will sue you.

Closing IP with debts: 2 atypical reasons

Reason # 1: if you need to change the taxation system

Sometimes there is a situation when you start to engage in another activity or "stalk" the error of your accountant / lawyer and you need to change the taxation system( from 15% on6% and vice versa).

But this can be done only from the next year( the Tax Code of the Russian Federation, Article 346.14 - http://www.nalkod.ru), and you need to earn money here and now.

The only way out of this situation is to close and open the IP anew, already on the required taxation system.

The procedure remains the same, you only need to carefully calculate the "worth the candle".

Reason number 2: if you need to "trail"

If you, as an entrepreneur, seriously "nakosyachili" and have every reason to be afraid of checks, it is worth thinking about "zeroing" - close IP, rest for a couple of months( cruise in the Mediterranean Sea in a luxury companymulattos are only welcome!) and start a "business" life anew.

If you do not have impressive debts, everything should pass without a hitch.

The following video will help you to sum up the procedure for closing the IP:

5 wonderful tips for those who decide to close the IP with

-

debts. If you understand that entrepreneurship is not yours, do not hesitate to close the IP.

Do not blame yourself!

According to psychologists, only 3% of people have the personal qualities necessary to become a successful entrepreneur.

-

Close the IP with the debts until their amount has really scared you.

In addition, state fees are charged for each day as an entrepreneur.

Do you want it?

-

Spit on the reputation and declare yourself bankrupt with all the ensuing circumstances, if the situation really got out of hand.

You're not a hussar in 1812 to shoot because of card debt. Life must improve!

-

A prerequisite for the closure of a PI is only the surrender of all securities to the Pension Fund.

And that's it!

Even the absence of any reports in the tax can not be the reason for the refusal to take you off the register.

-

When all the parts of the Marlezonsky Ballet are over( that is, the IP with the dogs is successfully closed), do not forget about the need to settle with your creditors : either pay it in cash, or carefully monitor how the debt is collected in court.

In the latter case, it is better to delegate this to an experienced lawyer.

All subtlety of the issue, , how to close the IP with the debts of , every entrepreneur can overpower.

You just need to decide whether to declare yourself bankrupt or to close the entrepreneur normally.

It is not superfluous to consult a good lawyer.

We are confident that this situation will be an invaluable experience for you, which is sure to come in handy on the way to real success.